The action in the stock market indices as of late has been out right boring in my opinion. Where is the volatility? It is almost non existent. This market is lately reminding me of the 1995 to 2000 time frame. Slow trending markets, low volatility for the most part with occasional brief corrections, and sometimes more notable corrections. It is utterly boring! I want to see volatility like we had in 2008, at the low in 2009 and the mini flash crash of May 2010. But I do not think my wish will be granted any time soon. I think it is fair to say that for the most part markets spend most of their time oscillating slowly in trading ranges or slow trends. Very high volatility is indeed a rare bird.

We are getting into the summer time frame where the market moves into a low volume typical trendless fashion anyway. But we are only in late May now.

The market has declined since I issued a BOT short signal on May 11, 2011 at 1338 and we are currently trading slightly above that right now. But this has hardly been a severe decline of any magnitude. I will keep the BOT short signal active for a while longer depending on how the market behaves the next few weeks going into the June 13, 2011 Marty Armstrong Cycle Turning Point.

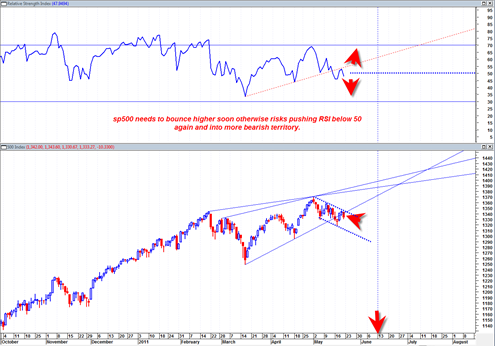

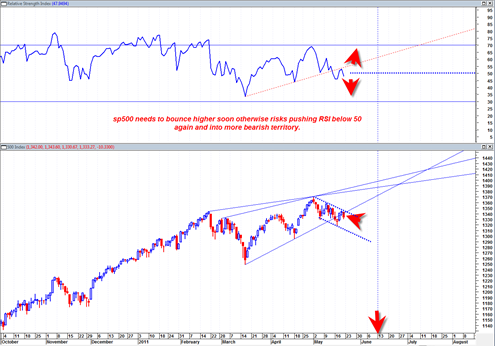

The fact is that the sp500 is still on a weekly sell. There is still a risk in the next week or two that the market decline can start to gain some more steam according to my charts especially if we close under this weeks weekly low next week which would confirm a weekly MACD histogram sell signal.

From a volume perspective, there still exists that mid March 2011 very high relative volume swing low of 1249. On the SPY ETF this was on massive relative volume and I think there is at least still a chance the market could get pulled down into testing that low again because of its high volume and the recent light volume rally since the mid March 2011 low.

Today we also closed under the short term up trend line for the second time. For a much more bearish scenario to develop I think we really need to see some down price action early next week to continue the break of up trend, other wise this could be just another typical weak correction.

Daily Relative Strength Index is in a stance where if weakened further could start to change the dynamics of the current market trend. So a down week next week would help to push that theory along quite well.

Indices such as the XLF Financials continue to be weak and sloppy. Not that the XLF has been the best indicator in recent months, but the XLF was never able to EXCEED the April 2010 high. I have to view this as a non confirmation and could potentially be a MAJOR warning flag for the broad market in the months ahead.

The XLF failed or double topped at the April 2010 high again and it could be on a path back down to the lower part of the range or the 14 level.

It will be interesting to see if this really is a top in the market at current levels, or perhaps we are simply in an extended sideways trading range with little forward progress.

it is unfathomable to me how you go on and on and on and on about June 13th. you advise that it is based on an 8.5 year cycle and yet you pinpoint the conclusion to one day. . . not one week, not one month, not even one quarter. good luck, i suspect, it will have the same significance as the famed “cardinal climax” for which you gave equal weighting about a year ago. good luck to you and those that follow you

Yes I have mentioned that it could be pin pointed to a single day or within a few days. But I have also said it could be within a general range. And I do keep mentioning it as a matter of importance because it is important. 8.6 years is a long time to wait for a potential turn signal, and if I see indicators starting to confirm the cycle signal then I sure as heck am going to talk about it for a few weeks.

And yes I was obsessing about the cardinal climax and rightly so because it was one of the single greatest turning points in the history of this market. Turns out it completely inverted into a buy signal and I had also framed the market for this occurrence as well and I nailed the bottom of that correction in August 2010 with my famous volume analysis posting when almost everyone else was bearish and scared.

And now AGAIN I nail another huge turning point with the BOT short signal a few weeks ago and here we go down town again in the markets! WOW!

I have made some great calls on this market, and in some cases much better than market gurus with 40+ years of experience. And I also have a good method of quantifying market action on multiple time frames AND am able to adjust the outlook if a previously strongly held belief does not confirm.

3 CHEERS to BestOnlineTrades! 🙂

Tom, is the Armstrong whose June 13th date you have been flogging repeatedly, the same Armstrong that Bloomberg reported in early March 2011 was let out of jail for a ponzi scheme. (exceprt cut and pasted below)

March 15 (Bloomberg) — Financier Martin Armstrong, jailed since January 2000 on civil and criminal charges stemming from what prosecutors said was a $700 million Ponzi scheme, was released from prison last week.

Armstrong, the founder of now-defunct Princeton Economics International Ltd., will be confined to his home until his time in federal custody ends in September, said Chris Burke, a spokesman for the U.S. Federal Bureau of Prisons. Armstrong is permitted to leave for work and will check in periodically at a halfway house in the Philadelphia area.

“I would like to take the time to thank everyone who has stood by me these many years,” said a letter under Armstrong’s name posted on the website MartinArmstrong.org. “What I have seen is the deep corruption that lingers through the political- financial system that threatens the future of my family and friends.”

TOM, – – – DID YOU EVER ONCE TELL YOUR READERS THAT THIS DATE WAS THE MUSING OF SOME CONVICTED PONZI SCHEMER? I HAD ALWAYS THOUGHT YOU PRETTY OPEN AND ADMITTING OF YOUR SHORTCOMINGS BUT TO WHY ON EARTH PUT SO MUCH STOCK IN THIS GUY – – IF HE IS THE SAME GUY?

I forget if I ever mentioned that part of his background, I think I have on a few occasions but only referred to him still being in jail, but I never went into depth about the case because I don’t know of his true guilt or innocence. I really do not care about whether he was put in jail or not, his cycle model is the best timing model ever created. The fact that he was in jail does not make it less so.

I agree you have a point, up to a point. “true guilt or innocence” – – presumably he was convicted and incarcerated for 11 years by a jury of his peers – – the American way – – that indicates guilt.

“the best timing model ever created.” – – – – wow! that is an incredible statement. as noted previously, it defies belief that any model can predict in 8.5 year cycles down to the day! what happened 8.5 years ago when the cycle last turned – – that would have been 2003 – – – what was so momentous at that time – – what “turned”. . . how come this ‘model” did not warn of the crash of 2008/2009? or what if March 2009 was really the 13th June 2011 date – – just off by a couple years, but in the overall scheme of things not a huge miss.

when June 13th 2011 becomes a reality, i will be very curious to see how you interpret it or how Armstrong interprets it (which i assume you will relay on this blog).

heck, if life and investing was so easy as to run in such 8.5 year cycles, exactly to the day. again – – what happened in late 2003 to mark the last 8.5 cycle turn – – – ?

From what I understand, Marty was held in jail by the US government for contempt of court. He never actually was given a trial or convicted of anything. They held him in jail for so many years for contempt of court.

The charge was that he was defrauding Japanese investors using his firm PEI as a ponzi type scheme.

So again, not know of his guilt or innocence.

The 2003 turn date marked the low of the 2000 to 2003 bear market, but it was by no means exact or very precise. Sometimes it is exactly to the day, and other times it is not.

Currently I am still a bit confused what will happen on mid June 2011. Sometimes the signals fade out and do nothing. It is starting to not make sense for the current move to be running into a major high…

Maybe there is another market that will turn on the date.

I think the model did pick the top in 2007, or the exact top in the real estate holders ETF. One can split the 8.6 year cycle in half to come up with other cycle dates.