Today again the market was reluctant to give up much ground and the volume was what I consider to be light on the SPY ETF. Wyckoff methodology is a great framework one can use to get a better understand of where the true trend stands. Today’s action in the sp500 seems to be still confirming that the trend looks higher from here.

The market is jumping and pausing, jumping and pausing in what I consider as pretty healthy type uptrend action.

I have to say that following the action intraday can make market interpretation on the daily time frame much more difficult. The closing price on the daily chart is always the final verdict for any daily chart interpretation. I have found that if I follow the intraday action too much it can confuse my ability to interpret the daily charts properly.

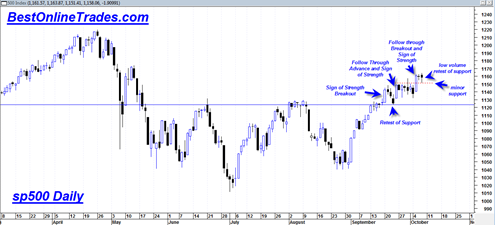

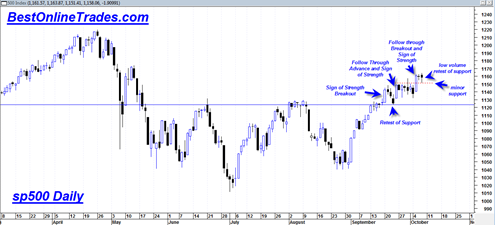

The labeled chart of the sp500 above shows the recent moves in the sp500 and identifies the various phases of the market action since the northward breakout above the key resistance level near 1120 which has now converted into support.

I see no reason to become bearish at this point. The tape is telling me higher still and a slow and steady up trend.

Also very key in today’s retesting action was that today’s retest also tested the small ‘shelf’ of price action that was pushing under the 1150 area between 1/11/10 and 1/19/10 (not shown on chart above). So this was an important retest and the market seems to be saying it could have confidence to move higher from here after a quick ‘touch and go’ of the 1150 floor.

This video was made a few days ago. Looks like he may have called the top of the Euro and gold. Must wait to see if Dow diamond pattern is going to make or break stocks

http://www.cnbc.com/id/15840232?video=1608465451&play=1

That is an interesting theory as far as DJIA. I might have to consider that as a possibility for a turn down again. But I wonder if that diamond can also be a continuation pattern. Hmm..