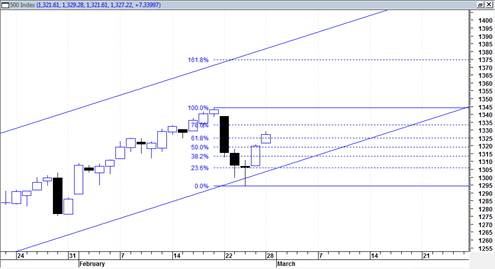

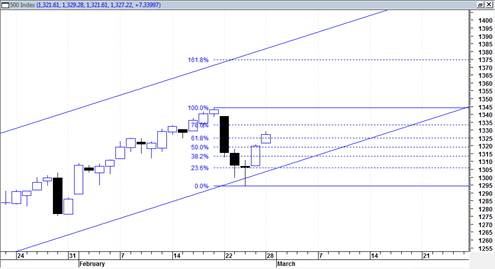

Today the sp500 closed above the key 61.8% retracement level that under normal bearish circumstances would be seen as a stopping point and reversal point for further bear market action.

There is still the 78.6% retracement level that is slightly higher from current levels (about 1334), but so far the sp500 seems to be in a quite respectable bounce mode after recently hitting the bottom of channel support with a reversal hammer.

We are still trading strongly within this channel and are now in bounce mode off of the bottom of the channel with a reversal hammer. This is potentially bullish continuation action and I cannot become overly bearish unless this channel gets busted in March 2011.

Amazingly today was also the last trading day of February 2011 and therefore the monthly February 2011 price candlestick was created. I mentioned in a previous post that the February candlestick had a potential of turning into a quite bearish looking shooting star formation. But this was almost completely avoided today and during the last two trading days market rise! Amazing that the market was able to pull that off once again.

It will be interesting to see if the market is able to get a move down again to touch the bottom channel support line. Perhaps there will be a rejection tomorrow and then some type of drift down move again.

If we are in a much more bearish scenario then one would expect a dramatic reversal tomorrow, or a hard down day. The bears need to make it obvious pretty soon, otherwise we may be in the typical garden variety minute correction and new 52 highs again.

The UUP US dollar index ETF is holding on to critical support now and if we break down hard from here it would be quite a dramatic development in my opinion.

So the bulls really need to see a higher low in the forthcoming days, preferable right on channel support. But the bears need a black negative candlestick that takes charge again and turns the recent pattern into an A B C down move.