But the problem is I am just a tiny water droplet and the market itself is an entire ocean. The market could care less what I think and it will do exactly what it wants to do on its own time.

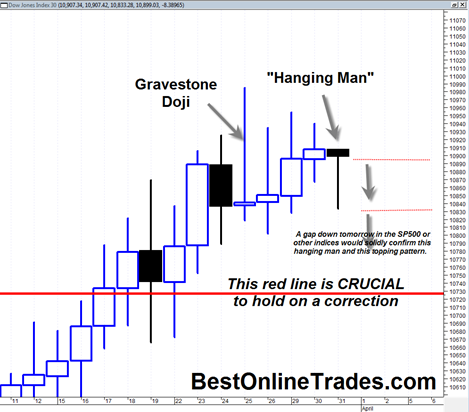

I have done a number of posts on what appear to be good reasons for a near term bearish resolution in price behavior for the sp500 and most other major broad market indices. But despite that recent bias, I have to pinch myself and at least consider a bullish possibility for the market going into the long Easter holiday weekend.

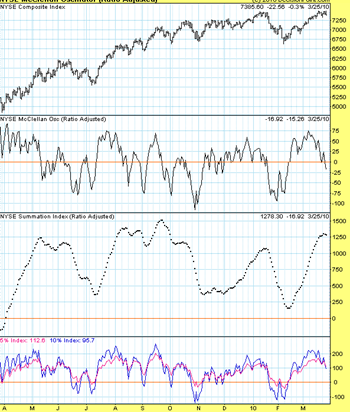

By many measures the market is overbought. But a market just being overbought is sometimes not enough of a reason for it to decline. It can continue into ‘tilt mode’ overbought before any meaningful price reversal occurs.

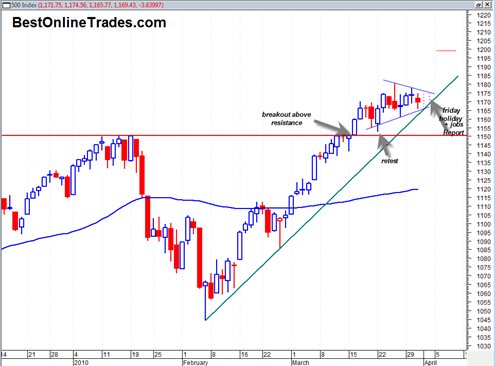

The jobs report is coming out this Friday. There will be no trading that day. So whatever the results are of that report will have 3 full days to build up and stew over the long weekend. That 3 day rest period before a market reaction usually leads to a very big opening move to start the following week. And the market as of late has a very strong habit of being up on Mondays.

But everything seems to be relying on the interpretation of Friday’s jobs report. Most of the news lately has been good news and it just seems to keep on coming, so why should this Friday be any different ?

I can speculate until I am blue in the face and will still not be able to figure out how the market will react on Monday of next week.

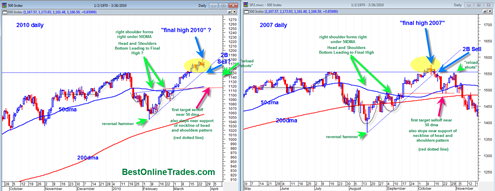

So here are the cold hard facts based on the chart:

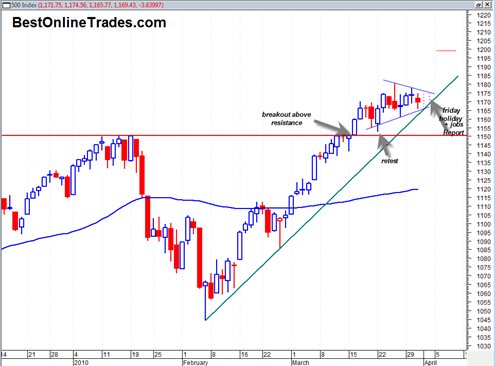

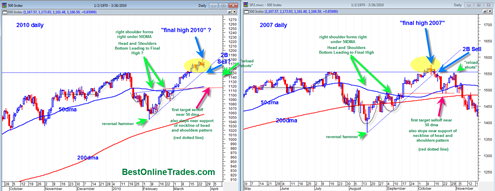

The SP500 since early February has been in a very strong uptrend. In early March it broke out above a significant resistance line with a moderate sign of strength and then attempted to retest the breakout area a few days later.