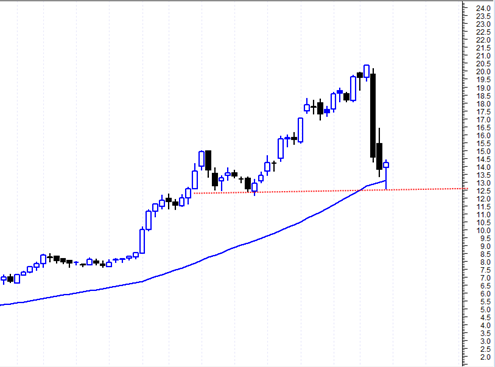

Everything is flying up lately including the ever so hated Fannie Mae and Freddie mac. These two stocks are laggards however they do seem to be catching a good spark and overall the chart structures of both seem supportive of a big breakout within the next two weeks or so.

I have been watching level 2 on both of these stocks and I have consistently seen very strong bid support relative to ask volume. In fact on some occasions the bid support has been stronger than ask volume by a factor of 10 to 1. So it is telling me that there is some heavy accumulation going on the last several days and ‘they’ appear to want to take both of these higher.

This should not come as surprise however because most other financials stocks are zooming higher as well such as AIG and BAC and C as well. Both FNM and FRE are late to the party so to speak but it could be that they are doing a pre earnings run up which I have not been able to confirm as May 6th, 2010. Yahoo Finance says May 10th, 2010.

Level 2 has been useful to me to see the demand and supply situation of a stock. Usually it is just useful for entries and exits but sometimes you can see a pattern emerge over time as seems to be the case with both FNM and FRE.