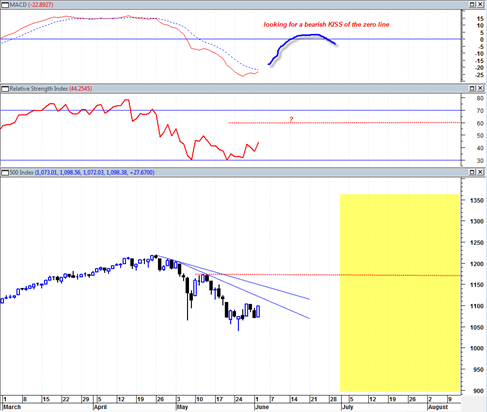

The words that make up the title of this post are not mine. They are Larry Pesavento’s words and I happen to agree with him. I continue to believe that this is an extremely dangerous market and that it is an environment of a weak and nervous bid. We literally could start to collapse at any time. We were able to drop almost 1000 points in a handful of minutes on May 6, 2010. Dropping 2000 points in double that time does not seem impossible either. This market is building a catapult or a spring board for the next big move.

I have spent a good amount of time over the weekend contemplating the bearish and bullish sides of the market and so I am just going to write out a potpourri of thoughts in the paragraphs ahead and also comment on today’s closing price action.

Why Should the sp500 go to 1150?

I think it is an important question. It seems like every technician in the world expects the market to zoom to 1150 to create a right shoulder of a larger head and shoulders topping pattern. I admit I have considered this possibility and wrote about how I was expecting that as well after the reversal of a week ago.

But after some contemplation I am starting to think this is much less of a possibility and that the advance that started a week ago may have either topped out today or by the middle of this week.

Why?

The sp500 going to 1150 or 1170 would make it much too easy for those who are currently trapped to recoup a large portion of their losses. Since when is the market Mr. Santa Clause giving previously greedy bulls all kinds of second and third chances to bail out break even ? It does not make any sense for this market to do that if it is in a persistently impulsive bearish trend as I predict it is.