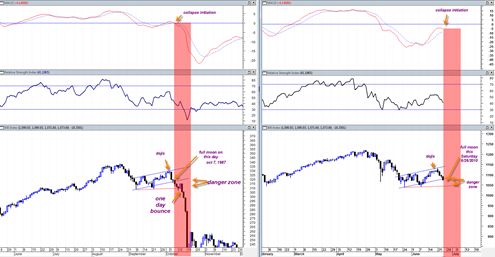

It seems as though a lot is riding on tomorrow’s price action. As of today’s 6/24/2010 close it would seem that everything is lined up for a hard down weekly close as I indicated before was an important requirement to continue the crash scenario.

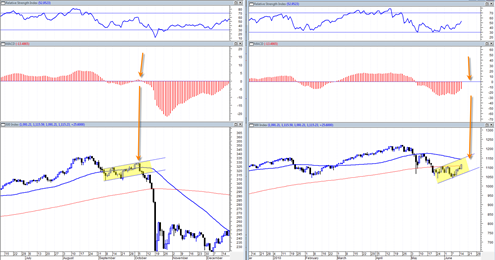

But when I look at the current sp500 trading channel on an intra day chart one can clearly see that as of today’s close we are in a spot were a huge upside bounce could come in. In addition 1076 is about where a 61.8% fibonacci retracement comes in from the June 8th, 2010 low. So there is some support and enough reasons to cause a big bounce. This really is a key area we are at right now.

So the issue is, do we bounce dramatically tomorrow early on and then fail at the end of day for a weekly close near the bottom of the range ? To me that would be the most ideal scenario going into the supposed bearish Astro Monday the 28th of June, 2010.

Closing weekly hard down right before the weekend has a way of allowing the market to build up energy over the weekend to accomplish a break of important support (in this case) or resistance.

So clearly the most ideal scenario for those bearish on the market is a close near the 1050 range tomorrow. Already being down 4 days in a row makes it seem unlikely we would get another down day tomorrow. However I have seen many times markets run up repeatedly 5,6,7,8 or 9 days in a row to the upside in the most bullish environments, so why can’t the market get a string of 5,6,7,8, or 9 days in a row of downside moves ? It is possible, but not highly probable.