In the days and weeks ahead I may start to do more close coverage of both the gold price and the mining stock sector. I may do this because of the chance that the gold price may soon unleash itself into a raging (bullish) monster and it could start to become more relevant and timely than any other sector in the market right now.

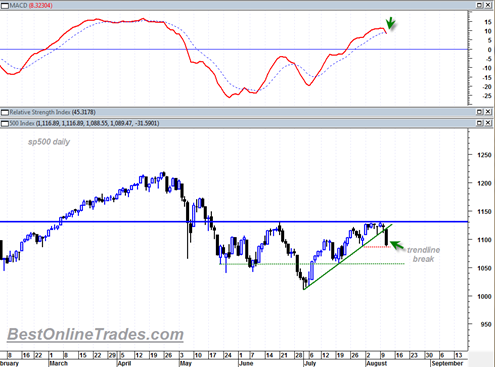

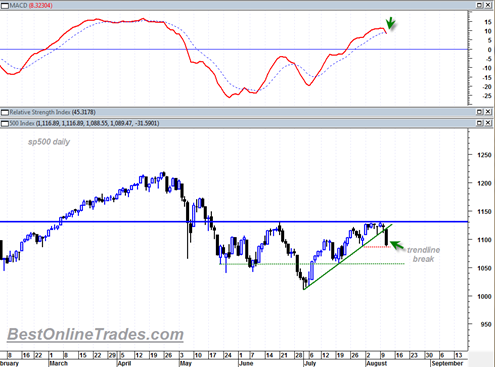

I have been doing a lot of coverage of the sp500 and the SPY ETF. But I have to tell you honestly, where is the trend in that market ? It seems like a wasteland of swing trading ranges and lack of real gusto in terms of direction. The direction will eventually reveal itself but I want to cover the areas that I believe deserve the most attention and ahead of everyone else before they become ‘mainstream’ ideas.

Of course I will still need more confirmation about the possible moves in the gold and mining stock sector in the weeks and months ahead but I am sensing that something big may be close to happening in this sector and I want to be on top of it before the dog and pony show starts on the major business TV networks.

It could very well be that the gold market will become the ‘only game in town’ soon. People have said that before but to be honest I have still up to this point not really noticed a mass public adoption of the gold story.