This may be one of the most important posts and charts I have posted in a long time. Market index analysis has a habit ( at least to me) of being MOST of the time fuzzy around the edges. But occasionally it starts to crystallize into a clearer picture and better form that helps build confidence on a certain forecast. It is a matter of making speculative forecasts, trying to identify key levels and then attempting to see whether the tape action starts to confirm your own forecast. If it does not then one must change tack and work with alterative scenarios. It is always good to have a small handful of scenarios to work with, both bullish and bearish otherwise it may leave you in a vulnerable position.

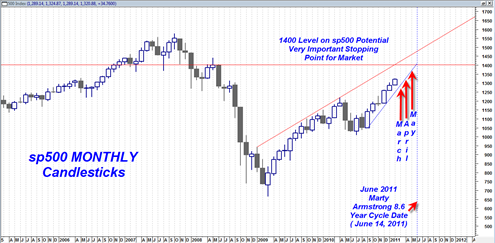

The current market is akin to a 200 car train that has no braking ability. It is sheer price force and momentum and this is to be respected and acknowledged before anything else. Having said that, it is also well known that no market can continue to go vertical forever. There must be a pause so that the market can form a pivot point for a new base that can eventually push the market higher. Markets build cause and then use it up. When they are done using it up, they need to build new cause. Of course after being in a market that seeming only goes up, it is always EASY to forget about any necessary looming correction.

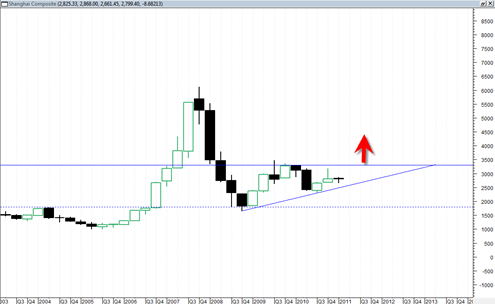

I have been picking on the nasdaq composite a lot lately and for good reason. The nasdaq composite index is approaching a key level that represents the start of one of the greatest bear markets of all time. This level was of course the late October 2007 peak in the market that preceded a long duration persistent trend bear market.

The key with the Nasdaq is the issue of how this 2007 peak will be dealt with?

- Will it simply be exceeded and ignored ?

- Will it turn on the exact tick of the previous 2007 high at 2861.51 ?

- Or will it AT FIRST be exceeded and then eventually succumb to supply forces at a later time?

Unfortunately we will not know the exact answer until it actually happens, but we can come up with some scenarios and attempt to get a better feel for the market as we approach this previous all time high level.