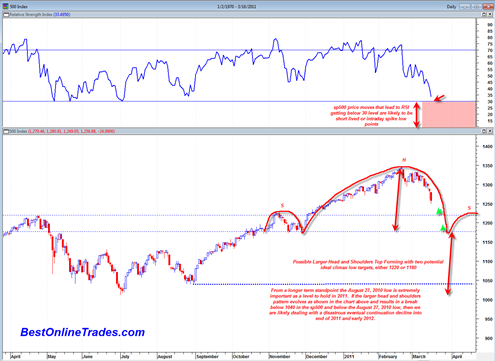

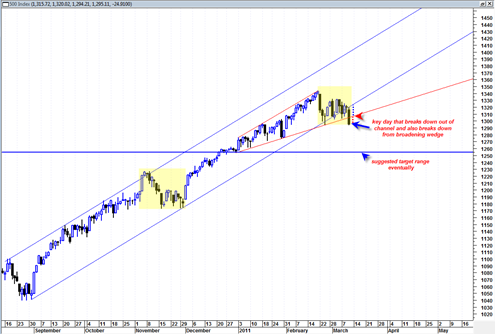

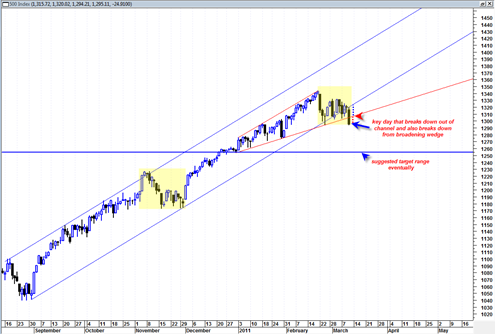

In my opinion all the pressure is on the “Bernanke Bulls” for the next 9 trading days as we go into the end of the first quarter. They are going to have to pull off their usual and typical ‘miracle runs’ where they manage to evade resistance levels, evade bearish candlesticks, and evade technical oscillators that are going against them now. Of course it is quite possible for this group to pull it off once again, but I do not believe they will be successful this time around. Already I am hearing elliott wave arguments about how we have to go to 1400+ first. I just don’t see it.

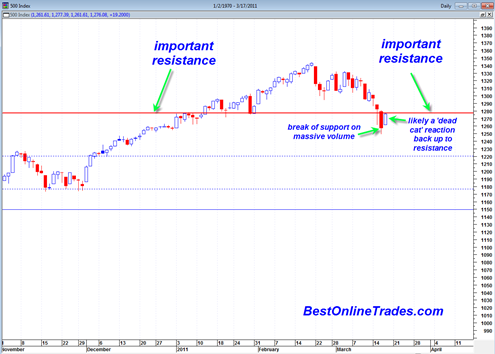

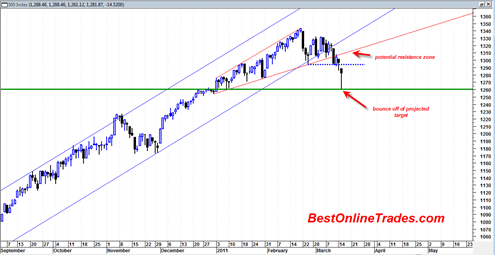

At this point I would say that 1294 is the battle line in the sand that defines who is going to win the next big move in the tape action on the sp500. 1294 represents a key support level that was broken on high volume to the downside. Now this 1294 level has transformed into resistance and should act like a brick wall for the bulls next week (assuming the bears have the right stuff this time around).

The daily candlestick today on the sp500 was a shooting star hammer reversal candlestick, but still unconfirmed. These reversal candlesticks on the sp500 have not proven to be very reliable. So the market could still easily trade higher early next week and evade the short term bearish implications of today’s candlestick.