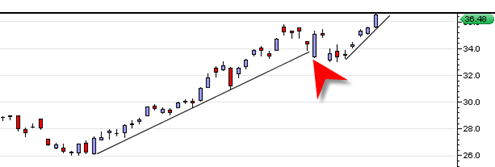

Today the gold price ETF and the spot gold price rallied up to life time highs but then sold off end of day to settle and close under yesterday’s low. I have seen this type of action before on the gold price as it attempts to break out to new all time highs.

At this point I do not believe the head fake. I think ‘they’ are trying to create the illusion that this was a reversal sell off and important rejection of the highs to be followed by another leg down. I think if they had closed the GLD ETF down much more, perhaps 2% or more it would have made a much more dramatic statement.

Instead, we see that the GLD pushed to new life time highs and tested two important price swings in early March on equal or greater volume, a positive sign.

After hours the GLD bumped up quite a bit, moderating the potential short term bearish looking candlestick. But again, it is only moderately bearish to me. I think today is a head fake to sooth the gold top calling crowd.

One mental trick to use when viewing intra day price reversals like we see in the GLD today is to see how negative a close occurs relative to the previous day’s candlestick. In some cases one can see a strong intra day reversal and yet the close did not even manage to get under the previous day’s high. In my experience those reversals are usually just consolidations rather than all out bearish trend changes.