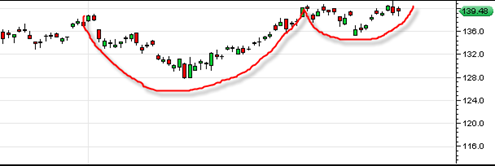

The silver SLV ETF continues to trade in a very strong manner. The SLV ETF recently appears to have completed a classic Wyckoff retest on dramatically lower volume of the recent support range. This is a very bullish sign and is not a time to think about shorting the SLV ETF in my opinion.

The recent retest of support was on 60% LESS volume and shows that the silver bears do not currently have the firing power to push this ETF down in magnitude. The absolute worst time to short any security is on a dramatically low volume retest of a recent break out area.

I suspect we will see a further short squeeze in the days ahead that should put the SLV near the 40 range. The silver ETF seems to be leading all markets higher. It has gold and the stock market on a leash and may pull them higher the next couple of weeks.

Looking at the chart below one can clearly see that we recently did a retest of the important support range on 60% less volume.