If the gold price is going to get a breakout going out of this large symmetrical triangle into the typically strong seasonal time period of mid-September, then it needs to hold above the blue trendline drawn above. It needs to remain above this blue trendline for the next month or so if an accelerated breakout scenario is to take place.

It would be an ideal situation for a breakout out of this symmetrical triangle because going too much further into the apex of the triangle could possible weaken any potential breakout.

I have labeled minor support along that blue up trendline as 92.18 on the chart of the GLD ETF above. I would expect at least a one day bounce after touching that line. A break under it would invalidate the near term breakout scenario and open the door to a move back down to the bottom portion of the triangle.

That bottom portion of the triangle would then become critical support that needs to hold for a chance at a breakout in a different time frame.

The gold price breaking below the blue trendline and then touching the support of the bottom of the triangle does not necessarily mean that the gold price would not be able to recover back to the top portion very quickly. We have already seen that the gold price is capable of making almost a 100 dollar move in one day. Now whether or not something like that can materialize between now and mid September is unknown.

It is clear that this symmetrical triangle is storing a lot of power for a big move. And the move, when it comes can be rapid, persistent and unexpected. The problem lies in figuring out which direction it will be.

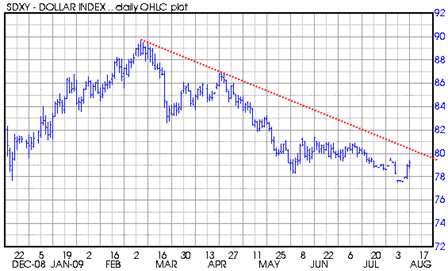

The bounce in the US Dollar index is bothering me because there is a bullish divergence that could keep the bounce going for a while.

And a break up and through the red down trendline could cause problems not only for gold but also the general stock market as well. So you can see there are several key levels in gold and the US Dollar that if broken could make for big trend changes. I should say that the relationship between the US Dollar and the Gold Price is not always 1 to 1. There have been divergences for periods of time where gold has held strength in the face of dollar strength. But over longer periods of time the relationship seems more consistent (ie. dollar falling equals rising gold and vice versa).

I am going to remain constructive on the gold price well into September as long as it holds the support of the bottom portion of its symmetrical triangle. If that level is violated then I am going to have to change my tune and be open to several other scenarios.

I will make a point of covering gold again this week as necessary.