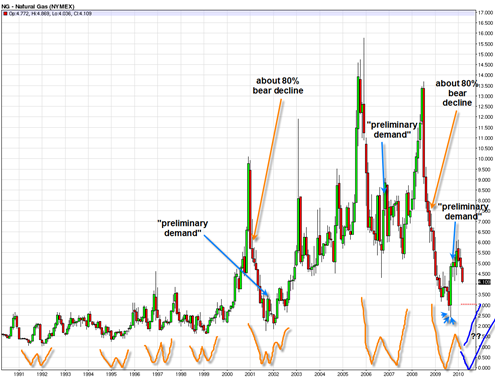

I am still watching the Natural Gas Contract fairly closely. I thought originally that Natural Gas Futures would trade down near the 3 level as a final bear market low. But there are a few elements in the current chart that have me at least considering otherwise at this point.

The the weekly chart of Natural Gas is used along with the Bollinger bands it paints a possible picture of a large W bottom forming with the Bollinger bands serving as support.

I recently just read over John Bollinger’s book on Bollinger Bands and he indicates through his book the identification of W bottoms along with the Bollinger Bands as confirmation.

He indicates that one might at first see price move out side of the Bollinger bands to create the first portion of the W bottom, then some type of rally can occur and then a retest of the Bollinger Band that does not break through the second time. the second retest is also typically right portion of the W pattern before the new uptrend emerges.