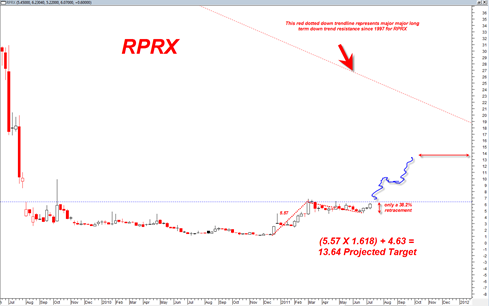

RPRX, a highly speculative biotech stock that I have mentioned on a previous occasion appears to be at an important juncture. The juncture is the 6.50 price level which it needs to fully exceed (preferably with a full price bar above the level) to consider it a breakout.

It would also be good to see the 6.50 price level exceeded with 700,000 or more shares in volume.

A breakout is not a breakout until it actually is. Strange as that may sound, it is true. I have seen many a ‘potential’ breakout, only to see prices reverse by end of day and fail back under and into the previous range the stock was trading in.

If RPRX is not able to exceed the 6.50 level this upcoming week with conviction then one may have to assume it will remain range bound and head back to the bottom of the recent longer term trading range.

For now I do not believe that will happen. My charts are saying that RPRX has a good shot at an upside breakout this week.