I have begun to wildly speculate the last day or so about how events will play out next week. Speculating on how events will play out and how they will affect the market or vice versa is one of the most entertaining aspects of trading to me.

I have begun to wildly speculate the last day or so about how events will play out next week. Speculating on how events will play out and how they will affect the market or vice versa is one of the most entertaining aspects of trading to me.

The problem with wild speculation about how events will unfold is that it is a very imprecise science and looking back I have to say that most of the time I got excited about how a particular outside event would play out turned out to be wrong in hindsight. What would happen instead is that the market would either completely ignore the news or do the exact opposite of what I thought. Welcome to the world of trading the markets!

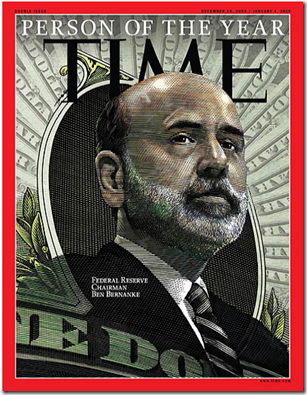

Anyway, I would like to say that I think there are two potentially pivotal events happening next week. The obvious one is the Fed Meeting. The not so obvious one is the Bernanke Senate vote on his confirmation for a renewed term.

So in a perfect world whatever the Fed does or says middle of this upcoming week will be predictable and ordinary with no major surprises. And if that perfect world keeps turning, then there will also be no surprises on the Bernanke Senate vote. The vote will be successful and he will be reappointed without any problems.

So that is the perfect world.

But what about the imperfect world scenario ?

The imperfect scenario goes something like this…

The market continues an accelerated decline to start the week of 1/25/2010 and becomes unstable enough to trigger a panic either right before the Fed talk/decision day or right after their talk/decision. Then, with the public/media and Washington political crowd totally shocked at how such a severe decline (crash or mini crash) could happen, the scheduled senate vote takes place and Bernanke fails to get enough votes.

That type of scenario is extreme but to me it is a good example of how market action (ie. mass social mood) can potentially change public opinion and political opinion very quickly. I believe that Bob Prechter in his discussion of the psychology of markets makes a similar point. That the market or deep social mood is the one that decides outcomes before they happen, not ‘headline news events’ as the mainstream likes to think.

The election in 2009 and the market action around the same time was a superb example of how the social mood turned deeply negative which was reflected by the price action and it resulted in political outcomes that might not have otherwise occurred.

So who will decide Bernanke’s confirmation ? The market or the senate? I don’t know. We will just have to wait and see. One problem is that I do not know on what day this senate vote is. I have been hearing end of the week, but it is unknown at this time.

If the market happens to be rallying higher in bounce form before the senate vote and then he is not confirmed, then I can easily see the Dow dropping 1000 points very quickly. That scenario would contradict what I just said about the market deciding (on the daily time frame), but the fact is that we already have a weekly bearish trend change, so one could still argue that the ‘market decided’ the outcome many weeks ago.

Again, I am wildly speculating here, but it sure is fun 🙂 .