If you look through some of my recent posts you will see how I was turning heavily bearish at certain points in some of my commentary lately. I mentioned about how I was going to start looking for short candidates and focus mainly on the short side of the market and not even consider the long side for some time. I did trade the TZA for a few days during the last week and a half (the 3X Ultra Bear ETF) and was lucky enough to squeeze a few percentage points of profit out of it during the last week and a half or so.

During this last week and a half I also tried to go short Bank of America with some put options only to close them out very fast with some small losses.

So why am I telling you this?

I am telling you this because I realize now that it was a mistake for me to talk about being ‘aggressive’ on the short side and a mistake for me to be talking about crashes or even astro aspects. Astro aspects can sometimes invert which can make their interpretation very risky. Better to focus on better sell signals like a simple breaking of support or resistance. And by the way despite all my bearishness the last week or two, it remains a fact that the SP500 never even broke DOWN through the longer term support line that remains in force from the March lows. So the fact that I was even considering going short or even looking to go heavily short until such a break actually occurred was a huge error on my part. I do apologize. And I sincerely hope that this post marks a good lesson learned.

Once again I can only blame myself. And once again I think what got me derailed was ‘too much research’. Too much looking what other people’s opinions are. Too much looking at posts on trading message boards. And too much listening to the bears talk of deflation and crashes instead of simply focusing on one simple thing…

Price, Support, Resistance and Trend and Tape Action!

and the violation of, or NON violation of price, support, resistance and trend.

Instead of me focusing on the ultimate price decision points and the tape action itself, I started to worry that we are in a deflation scenario that could mark a critical top in the market now and that could send the market plummeting fast similar to what happened in 1929. So let me put this ‘deflation scare’ to rest now.

I just cannot see a deflation scenario happening. Gold is at all time life time highs. And the powers that be will at all costs pump as much money as humanely possible into the system to prevent deflation because if they had to chose between the two I really believe they would prefer inflation over deflation. And that is exactly what is happening now, the markets are getting pumped up with an inflationary easy money recovery. It is slowly spilling into many different parts of the economy whether it be housing or retail or commodities.

Now at some point this inflationary pumping will probably cause the economy to suffocate, but I think we are along way off from that, maybe 1 year or more away.

Yes we will have a correction eventually in the broad market and it will probably be somewhere in the neighborhood of 10 to 15% and probably a good portion of it will be sideways basing action in the form of multiple double or triple bottoms. At the bottom of that correction I can guarantee you that you will hear all kinds of forecasts and predictions about how we are going into a 1929 scenario and how we will soon break the March lows etc. etc. Ignore it. And realize that this sentiment will be precisely what supports the market in the form of short covering near the bottom of the next major correction (10 to 15%).

But for now I expect this market to slowly grind higher and keep teasing the bears.

Going forward, I am not going to keep my commentary in the mindset of trying to pick a top every other day. That is the road to ruin. If I see CRITICAL levels being broken to the downside and the WEEKLY MACD turning down in a confirmed bearish cross then I will probably make a post about how we are ready for some 10 to 15% NORMAL corrective action to calm down the bullish consensus a bit before another move higher thereafter.

Going forward we know this:

1. The current primary trend is UP, strongly up and we must assume this to be the bias until we see critical levels and indicators telling otherwise.

2. Many individual stocks have a mind of their own sometimes. Some stocks since March have not gone straight up since March 2009. Many of them have been in sideways consolidations that look quite bullish. So what I need to do is identify these stocks and or ETFS and then find profitable setups regardless of what the Indices are doing. I am not going to be completely blind to the indices, but I am not going to go into panic mode every time the DJIA declines 30 points either.

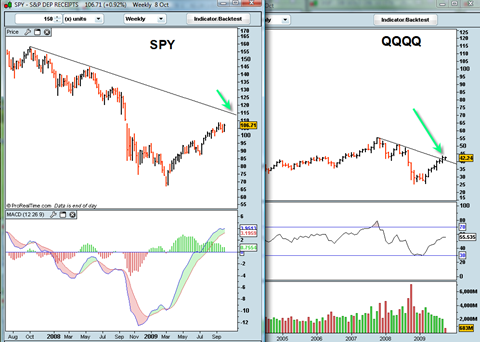

3. The weekly price close on the SPY and the QQQQ look like they will be quite bullish this week. The SPY has not yet fully filled the gap up to 109.60 and I suspect it will probably try to do that in the week ahead. After that it probably has a decent shot at 115 which is right where the down trendline is. As you can see from the chart at the top of this post the QQQQ has already pierced its long term bear market down trendline AND also tested it on the daily chart. On the weekly chart is has pierced this down trendline and this week looks like an intra day weekly reversal.

So there you have it! The road map in my mind going forward. Find good stock setups and ETF setups and focus on capturing profit at well defined levels. I just need to be a machine and focus on that like a laser because it really is key in trying to get ahead.

And no more visits by me to super bearish sites or heavily bearish opinionated sites or forums or twitter posters. That whole conversation about crashes and deflation and end of the world talk is a total utter distraction from the business of finding profitable setups.

Lesson learned!