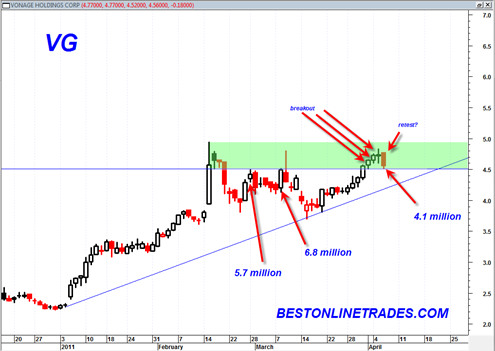

I am already underwater on Vonage Holdings by 2.56% today after today’s drop to support. I would like to see VG hold 4.5 support for an eventual move higher. Ideally there will be no close under 4.5 in the next several trading days.

In hindsight entry should have been at the lows of today rather than the price action of the last few days.

It is possible that VG is currently doing a similar Wyckoff low volume retest to the one that occurred in the SLV ETF several days ago. The low volume Wyckoff retest in silver led to the recent huge upside move. Certainly VG is not worthy of comparison to SLV in a literal sense, but price and volume on the most basic level is essentially the same whether we are talking about tech stocks or obscure commodities.

I do see that VG has an unconfirmed earnings date of May 2, 2011 which may complicate matters a bit. Still for now I stay long VG and see if it can hold 4.5 support on a closing basis.

Looking at the chart above we can see that VG has accomplished a breakout (albeit a somewhat lackluster breakout) and today appears to be in retest phase on lower volume compared to previous swings. So again, ideally VG holds above 4.5 and trades within green shaded zone for eventual move above 5.0. I want to give VG enough time to get some footing in the current zone. What would cause me significant concern is if VG starts a rapid decline under 4.5 and closes under 4.5 with weak tape. If we do decline under 4.5 I would like to see a bottoming tail created under the 4.5 range.

VG is the first trade of a ‘project’ I will in future posts refer to as the MASTERMIND Project… More on that later…

VG is selling for approx. 140 times earnings. Not sure that would be a good speculation