With the market hitting new highs and many big cap stocks also hitting new highs I suspect a lot of people are afraid to take big new long positions at this point for fear of ‘buying high’.

I have been studying the UNG for about a week or two and the tape action in recent days has been quite encouraging for a possible long setup now. I think it is fair to say that buying the UNG ETF at this point would not be an exercise in ‘buying high’ by any means. It doesn’t mean it cannot go lower, it can, but in the context of the move since about a year ago, UNG has been absolutely slaughtered and in one of the most persistent declines I have ever seen. It looks almost worse than the 1929 3 year crash.

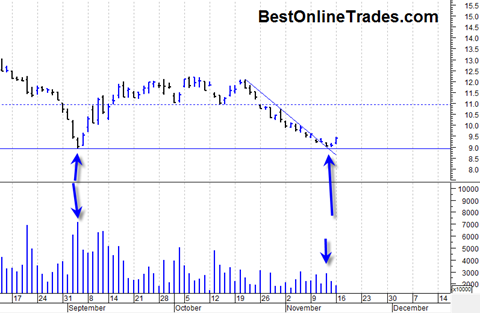

Anyway UNG could have a double bottom formation here in the making. A bunch of indicators I look at are saying we should get some upside continuation this week. Everything from the daily 14 day RSI, Williams %R, to stochastics and a faster moving MACD indicator are saying we should have an up week in UNG.

I also like the low volume price action near the 9 level in recent days as compared to the blow out volume of early September which maybe could be considered climax volume bottom? The low volume retest is telling me UNG does not have enough energy to blow out the 9.00 lows this time and will try for a move back up to 11 or so, then back fill for a bit and maybe later on get an attack of the 12 range.

So definitely a contrarian type play here and something different from gold, the broad market, or almost everything else which is red lining into overbought territory.

Whether this is the final bottom in UNG or not is way too early to tell. For now this looks great to me with protection slightly under the 9 level.

Here is another chart and take on the UNG ETF which I found trolling through some yahoo message boards…

Also I found this cool site Smithsintheblack who also apparently made the bottom call in UNG perhaps this last weekend or early last week. It is a cool site and they have a neat little chat room in there too. I love the title of the site too and there is some good chart work and other data on the site as well. Definitely worth checking out. It is amazing how I seem to find certain sites and data on the net. Occasionally you run into some really good stuff almost at random. Amazing.