The gold price move seems to be well underway now and today we saw the US Dollar Index have its worst one day drop since July 31st. The dollar could be entering free fall mode for a week or two that forms some type of capitulation low. Gold is overbought now based on RSI levels, but at this point I am not seeing any negative divergences. So it could get a few drops here and there and maybe even form some type of consolidation pattern only to take off again later.

The gold bulls live above the 70 RSI level and they should control the show for at least a couple more months. The way the gold parabolic blow off and also the broad market are setting up is for a big finale of a run that coincides with the US Dollar Index hitting support near the 70 range.

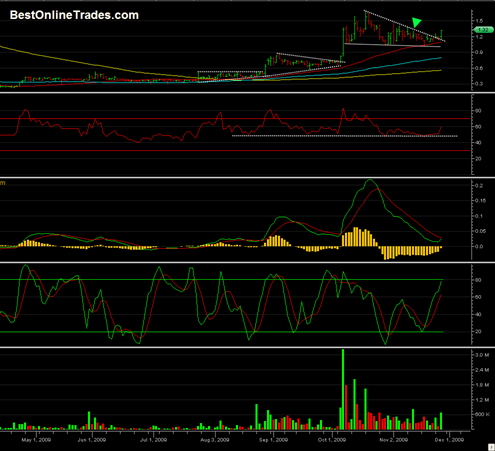

In the mean time TLR continues to behave quite well and now looks poised for the classic ‘15 minutes of fame’. Well actually it will be more than just 15 minutes. Today is probably the first day of a 5 to 10 day rally in TLR. I am looking for 2.00 as a target to exit. I think it may have a decent chance to get there within the next 5 to 10 trading days.

TLR should do well as a long term play into 2010 but I would rather run for the hills within the next 5 to 10 trading days near a 2.00 target. TLR has a tendency to drift sideways for ages and then get some mini runs going. It reminds me a little bit of biotech stocks.

So TLR should be able to get its RSI level above the 70 line in a big breakout type move which will put the RSI at extreme overbought. Then I would expect a 2 to 3 day modest decline that gets the daily RSI oversold again down into the 70 range. Then, TLR should rally again and typically the intraday high on that next rally could be the best one to sell on in my opinion.

By the way, do you see on the chart above that little green triangle? That was my entry point and I am telling you this to point out that it was a HUGE HUGE mistake despite the fact that this trade is now playing out well. I think at the time I had a couple of other bad trades and was too hasty in making a decision. My emotions got the best of me.

I should have never entered TLR until and if there was a valid TOPSIDE breakthrough of down trending resistance. I have made this mistake quite a few times in the past but at this point there really is no more excuse for making that type of mistake. It can potentially be a very dangerous and costly mistake.

After my entry TLR drifted down to the 50 day moving average and so I had to go through some nasty draw down sitting on egg shells for a while. Needless to say it was an unpleasant experience and could have all been avoided had I simply waited for the valid signal that occurred today.

Anyway so my point is don’t ever make the same mistake I did, it can get you into major trouble if things don’t turn around and go your way, or if you don’t have a bull market to bail you out!

In other news I am pleased to report that the GLD 100 2010 calls that I mentioned on August 3rd 2009 at about 4.00 are now valued near 17.15 , or a gain of 328%. At the time I made that call I was counting on gold breaking out north from 2 very large technical patterns. Despite the call, it was still very risky especially because it was an option. If the wrong expiration month was selected, or if the initiation of that trade was taking too early ( for example in the large symmetrical triangle that made up the right shoulder of the large head and shoulders pattern) then the option would have probably expired worthless.

Gold is nice when it trends, but most of the time it seems to spend an eternity going sideways or doing some other complex type of pattern.