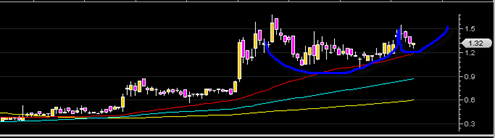

Timberline Resources is holding up quite well above its 50 day moving average (red line) and the recent 3 day decline has been on dramatically lighter volume. The gold price has made a nice upside reversal reaction as well as the GDX mining stock index and I suspect that both will retrace upwards a bit this week and then move into longer consolidations perhaps 2 to 4 weeks long.

TLR could be forming a small handle of a cup and handle type formation here. A large surge in volume is really going to be the only clue of a breakout type move out of this pattern. But there is also the risk it may just flat line for the rest of December as it has done in the past.

Still worth keeping an eye on TLR in my opinion as it is a nice upward trending gold stock in a basically sideways consolidation with low volume decline days and big volume accumulation days.