This may be one of the most important posts I ever write. Well, actually scratch that… this may be one of the most important precursor posts I ever write to the eventual ‘signal’ post that I do on the UNG natural gas ETF.

As of the date of this post, it is clear to me that the current most recent trend is down in natural gas futures. The recent natural gas inventory report that came out last Thursday at 10 am helped to kick off another bearish leg down in this all to abundant element. But my take is that there is a lot more to the story than that. There is a larger chart structure that may provide some significant clues as to what natural gas will do in the future. More on that in a moment…

But first I just think it is really fascinating how Natural Gas Futures have been behaving for the last year. It seems to have a completely independent mind of its own and could not care less what oil, gold, or the stock market is doing. This is an important fact and one of the reasons why I like to keep track of what it is doing.

Why? Because it can provide a potentially completely different and much better risk reward setup when most other securities and indexes are all doing pretty much the same thing. That trading dynamic is my favorite one because it potentially allows you to participate in a brand new trend that is in a completely different trading cycle than everything else. It allows you to completely separate from what 90% of what everyone else is doing.

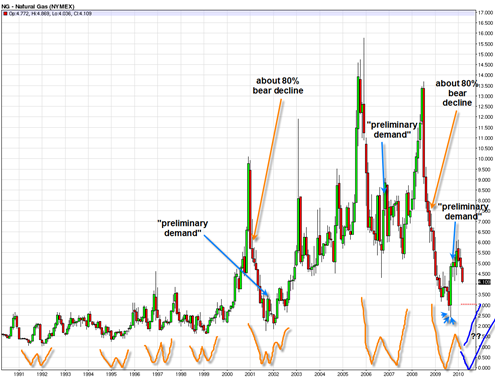

The long term chart of Natural Gas is the big clue as to when something interesting may start to happen with the UNG ETF. If you look carefully at the long term monthly candlestick chart of natural gas, you can clearly see just at first glance that this is a very volatile instrument, especially in recent years. In fact it somewhat looks like a biotech stock with extreme swings and very sharp peaks and bottoms. Perhaps it also resembles a penny stock with erratic movements and sharp turns.

But the long term chart is a monthly candlestick chart, not daily, so it is clear from the chart below there were definitely extended periods of persistent price movement with big gains to be had on either the upside or downside.

It is also clear from the chart that the biggest volatility has been occurring since the year 2000.

So the question… are Natural Gas Futures trying to form a bottom ?

Jake Berstein, the famed commodity expert trader and seasonal commodity cycle expert has been talking in recent months about Natural Gas being in a bull market now. I don’t want to misquote him, but I believe that is the extent of his stance now. I cannot speak to his detailed analysis, but I know that he does also follow COT (commitment of traders reports) closely.

I hate to disagree with him, but at least for now my take is that Natural Gas Futures are not quite ready yet to start the real bull trend.

If you look at the chart above you can see that this commodity seems to have a strong tendency towards making W bottoms and especially so after the most severe bear market trends the preceded them.

I have drawn in below the price chart where these W bottoms have shown themselves. The key point to remember with bear markets in anything is that after a very severe bear market, it is not at all uncommon to see a 100% retracement that does a retest or W bottom of the previous low. So for example if a bear market moves price from 10 to 1 and then a rally occurs to 2, then it would not be too uncommon to see price do a 100% retrace back to 1 before a major change in trend occurs.

I have also drawn in with the blue arrows where it looks like preliminary demand occurred. These are the first round of brave buyers who stepped up to the plate.

So the question is, will natural gas do another clean W bottom in the months ahead ? The answer to that question is crucial when determining where UNG may eventually bottom.

I believe that we could see natural gas trade further down in the months ahead and possible get to the 3.00 level or maybe between 2.5 and 3 as the final low. If it gets down there I can tell you that I am going to be paying extremely close attention to see how the monthly candles develop.

The previous big monthly candle in 2009 that hit a low of 2.5 has a big bottoming tail which shows significant demand that came in. This is why I think 3.00 could be the ideal retest level and final bottom in the months ahead. But I could be wrong about that. It would be the most ideal situation for a major bottom to occur in natural gas. But how often does the market give you an ideal situation ? Not too often. So we will just have to wait it out. It could just as easily bottom before hitting 3, but we will have to look for clues ahead of time to see if we can identify it.

But I am hoping and praying we get a 3.00 or between 2.5 and 3 retest on the long term chart as it would potentially set up a major major buy signal that marks a huge buy point and final bottom of this bear market in natural gas.

The problem is that the UNG ETF, severely lacks in performance when it tries to track upside movement in the natural gas contract. However it does track the downside performance in the natural gas futures quite well. That fact had me calculate a possible price in the UNG of between 4.5 to 5 if and when the natural gas contract actually gets to the 2.5 to 3 range.

But even if the UNG does bottom along with the natural gas contract assuming the contract gets to the 3 range still leaves the dilemma of how to participate in enough upside in the UNG.

I think call options on the UNG is one tool to use to make up for the lack of upside. If I am correct in the potential large significance of the bottom forming in the months ahead, then it could lead to a 100% upside move in the UNG. That gain combined with upside option potential should be adequate enough to get the most juice out of this potential longer term trade setup.

The sad part about all of this is that this setup may take several months before it becomes a reality. And obviously it is all about the timing. If we actually do get a W bottom, then once it has fully completed its formation, it will probably never look back.

So the key is getting the timing right!

Stay tuned…