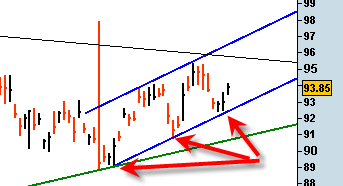

The SPDR Gold Trust (ETF) GLD was able to get a nice bounce going today off of blue trendline and channel support.

The SPDR Gold Trust (ETF) GLD was able to get a nice bounce going today off of blue trendline and channel support.

I am starting to get a few grey hairs watching this gold price trade inside the channel and also within the larger triangle. I imagine that there are plenty of gold bugs out there who are also growing a little bit impatient with gold. The GLD has been trading and consolidating going all the way back since March 2008. In terms of trading time, that is a lot of time.

I am nervous about what the resolution will be with the SPDR Gold Trust (ETF) and I was especially nervous the last few days as this blue channel support was being tested and the US Dollar was perched for a breakout.

But it did not happen. The dollar broke down again and gold jumped back, but the volume on today’s advance was really light so the sustainability has some doubt. But I have said it before and I will say it again, as long as the GLD can hold within this blue channel, it says to me that the GLD has a good shot at a breakout from the entire larger triangle structure by September 7th to 10th time frame (the seasonally most powerful time frame for gold).

I know I probably sound like a broken record that keeps repeating, but if the GLD falls below the blue channel line then it delays my Sept. 7th to 10th breakout scenario and opens the door to longer consolidation within the larger triangle and then makes it important to start watching how well lower triangle support holds.

It continues to be very interesting to watch the behavior of gold and the dollar for the second half of this month and all of next month.

Here is a good article over at 321gold that talks about how gold breakouts PRECEED US Dollar breakdowns. It is an interesting observation especially during this critical gold scenario I keep writing about.