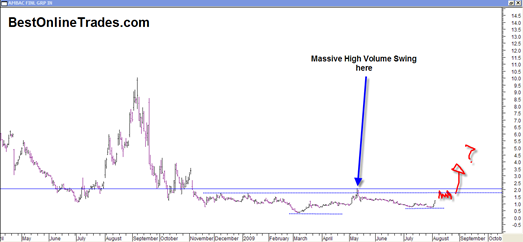

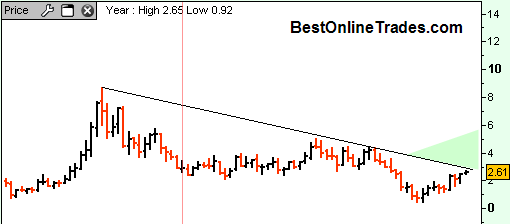

US Steel was up almost 9% today after my mention of it this past weekend. I talked about how it appears to have a large head and shoulders bottoming formation. Today’s action makes it look like the breakout from this pattern is in force.

The volume was very robust today especially for the first Monday in August. This large head and shoulders bottoming formation has some rough targets.

I calculate about 20 points between the low of the head portion of the pattern and the neckline of the pattern. So the minimum measurement rule here suggests that US Steel could get to about 60. Assuming this is the real breakout this week, then one thing to watch for is the retracement back to the neckline. That may serve as a second opportunity to ride this new uptrend.

The size of this pattern is significant in that it is almost 1 full year long. That is a lot of cause for a sustained move. Head and shoulders bottoming patterns tend to be quite reliable in my experience. They are not perfect patterns, but they do tend to give very reliable signals.

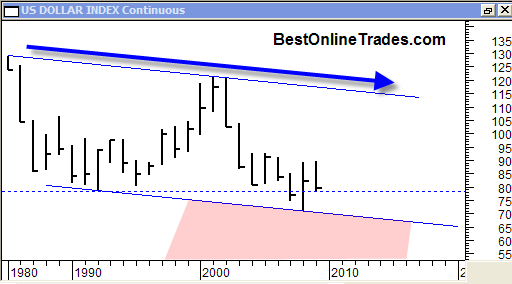

It should come as no surprises that US Steel got this move going in light of the fact that the US Dollar Index has broken down again in the most recent two days. I talked about the US Dollar Index several other times and have said repeatedly that it is at a crucial juncture and at critical support. Now it has elected to break that critical support.

Read more