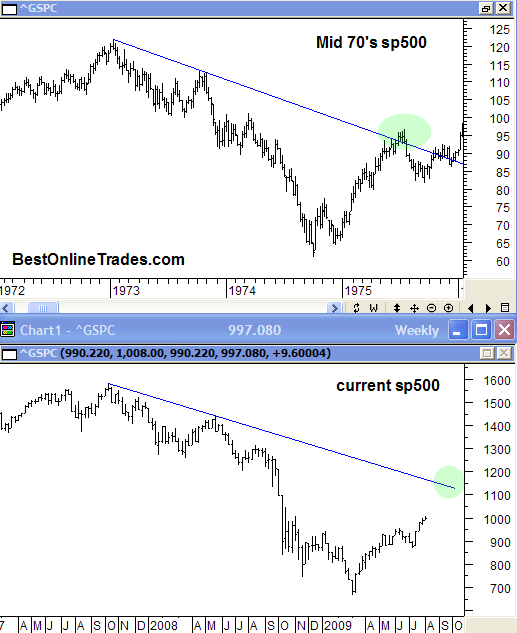

The SP500 is about to get a bullish monthly crossover on the MACD indicator, a popular moving average combination indicator that can become very useful over longer time frames. The monthly MACD signals can signify new major bull or bear market moves with sometimes 1 year or more duration.

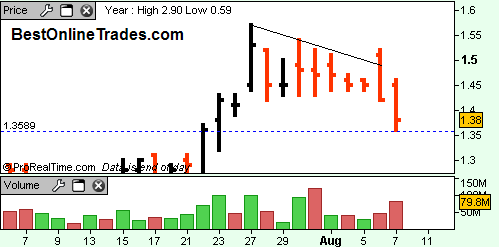

The current daily MACD signal is starting to flash some near term sell signals and could set us up for a move to test the 940-945 range on the SP500.

It is confusing sometimes when you have a sell signal on one time frame and a buy signal on a different time frame. To help clear the confusion, I always keep in mind that the longer term time frames have precedence over the shorter ones. So while we could get some selling pressure into 940-945, we must remember that the longer term signal is indicating higher prices.