Here at BestOnlineTrades I like to look back on what I talked about and see where things either went right or wrong. It is useful because it helps me figure out how I might be able to improve in the future or eliminate errors in judgment. I highly recommend that you do the same. It is really easy to make a trade and then forget about it, especially if the trade went bad and you lost money. But if you take at least a little time to review some past trades it could serve you well in the long run.

I first talked about PACR on July 31st, 2009. On that day the close was 2.49. Today it is 4.26 or 71% higher. This was an outstanding setups in many respects. PACR had a bottom in March and then a double bottom retest in July. It then went into a compression of sorts in the form of a triangle and the price trigger was activated on July 31st. The volume on the breakout was outstanding.

The most ideal entry for PACR would have been on July 30th even though it was still inside the pattern. A buy stop probably would have worked quite well on PACE just above the down trending resistance line.

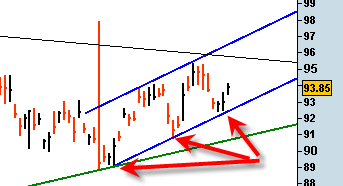

The SPDR Gold Trust (ETF) GLD was able to get a nice bounce going today off of blue trendline and channel support.

The SPDR Gold Trust (ETF) GLD was able to get a nice bounce going today off of blue trendline and channel support.