Well Thanksgiving is over, the world is still turning and China is an economic powerhouse that needs lots of energy and food to keep its people and growing economy happy. Can you imagine how many turkey’s they would need in China to feed every family there? Hmmm lets see, the population of China is around 1.325 BILLION people. So let’s say 1 turkey for every 3 people… so that would be four hundred and forty one million, six hundred and sixty six thousand, six hundred sixty six freaking turkeys!!! (441,666,666).

Clearly China is the 100lb gorilla taking the world by storm. I mean just look at the run that Baidu (BIDU) stock had, what an unbelievably huge run. Chinese stocks can be huge runners and huge winners for the simple fact that there is such large untapped market potential for all sorts of products, everything from fertilizer to solar panels.

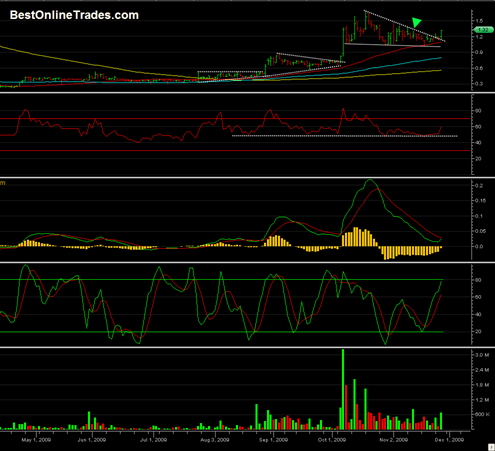

YGE is looking damn good right now as a potential setup. YGE does solar panels in China. Solar stocks from my experience seem to be somewhat of a bumpy and unpredictable ride sometimes. They can have some occasional really good periods of outperformance and then just go into hiding for ages. Part of that could be due to the ever changing oil price as perhaps a rising or spiking oil price can make solar seem more cost competitive. And incidentally from what I have seen in the oil charts I would not be surprised to see another trend higher in the oil price soon as we have recently seen the dollar break down into a new free fall mode. That should support higher oil prices for a while.

Anyway, regardless of the funny mentals, the chart of YGE seems to be saying that YGE could be preparing for a big sustained run perhaps into the 20 range or higher.