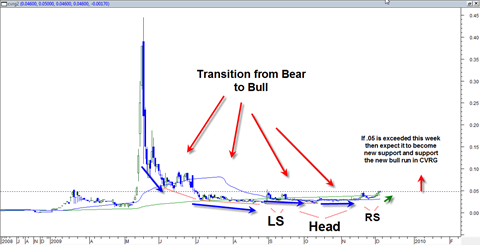

Before I even begin to talk about CVRG let me say this. CVRG is a PINKSHEET penny stock that is extremely speculative and has all the normal disadvantages that normally come with pink sheet stocks. I consider penny stocks in some ways less risky than options because they do not have time decay, premium and expiration, but that does not mean they still cannot cause major heart ache.

I made a decision a while back not to talk too much about pink sheet penny stocks here at BestOnlineTrades because they are an entirely different animal and just do not seem appropriate to mix in with all the other ‘big board’ topics I cover here. But occasionally I make an exception and I am doing that now.

So having said that, and since I have free editorial reign here at BestOnlineTrades I want to tell you about CVRG, Converge Global. It is a pinksheet gold mining penny stock. The ONLY reasons I think CVRG could become a nice play for the next 2 to 3 months are because of the technical setup that exist within CVRG and also the backdrop of a parabolic exploding gold and silver price.

We have already seen a number of gold mining penny stocks blast higher in recent weeks and I expect this trend to continue. SGCP (Sierra Gold Corp) up 900% from its recent lows, BRYN (Bryn Resources) up 4042% from its recent lows, KATX (Kat Exploration) up 1035% from its recent lows. So clearly speculation is ripe and the gold mining pinksheet penny stocks are on fire and in heavy demand. Part of the reason for this is simply a matter of supply and demand. There are so few gold stocks to choose from that what you will see is ‘gold money’ funnel more easily into the micro cap gold mining plays on pure speculation and lack of other choices.

Read more