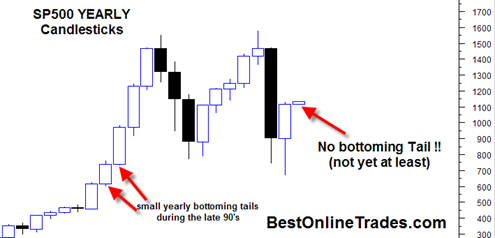

I am kidding of course, but I had to write a catchy title for this post given how we are starting the first day of the new year in the market. I find it very significant that we ended the 2009 YEARLY price candle only inches away from the high of the YEAR. And now on the first trading day of the YEARLY 2010 price candle we are in a gap and go situation. That is an extremely bullish type of candlestick behavior because it does not create any ‘bottoming tails’ on the lower portion candle.

It is true that we can still see some type of selling the next week or two that will create

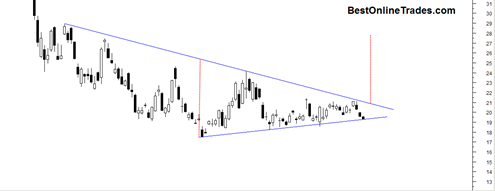

So far at least we see a huge sign of strength today across the board. Even the financials (XLF) are rallying after that very long consolidation pattern which could have been seen as a major topping pattern.

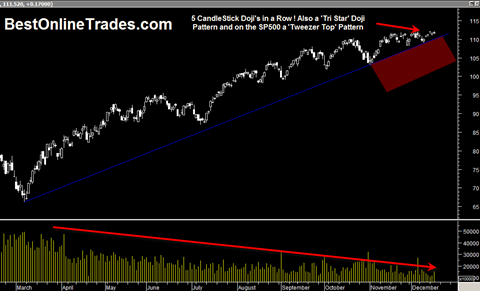

Obviously I was stopped out of my TZA position this morning. And at this point I have decided not to go short again later this week. In fact I am looking for long side opportunities again.

One just has to respect the bullish tendencies of this market. So I think finding long opportunities is the early game plan again for now. But at the same time being aware that bullish sentiment readings are at record levels and make the long trade a very crowded type of trade.