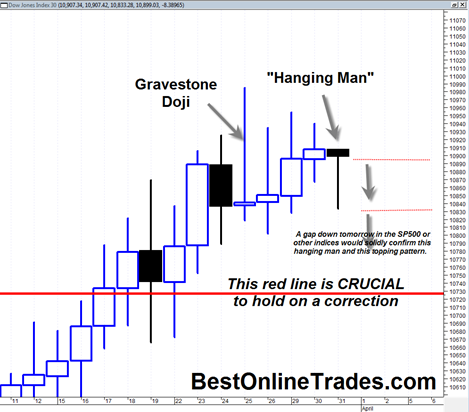

I am a bit frustrated with the stock market indexes right now. In fact to be honest with you I am sick of them. There are still opportunities on the long side on plenty of individual stocks (Las Vegas Sands Corp is one of them), but in my opinion it is too late to jump into the long side of any indices, even if they do go to 1200 to 1250 on the SP500.

Where is the risk reward ?

The risk to reward ratio on the indices right now seems like it is close to 2 to 1. Two ounces of risk for every ounce of reward.

Now as far as the short side of the market and the inverse ETFS such as the Direxion Daily Small Cp Bear 3X Shs (TZA) ETF, it would seem that this inverse ETF still offers some good risk reward to the upside. But the problem is that today’s close in the indices was still more of the same. Inching higher like slow water torture 1 point, 1 day at a time for the next 30 days. That trading dynamic can go on for a long time and to be honest I don’t know when it will stop.

So that means that despite the apparent good risk reward in the inverse bear ETFS, unless they start performing from the get-go next week, it will be more of the same as their inverse dribble down relationship mirrors the dribble up move of broad market indices.