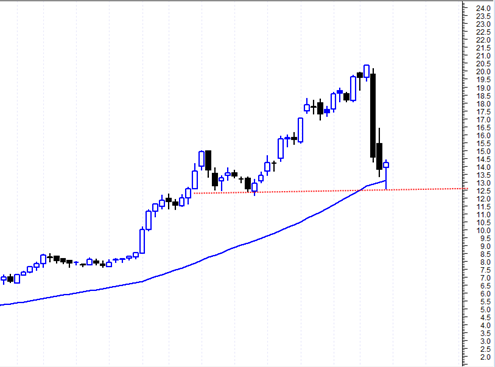

HUSA Houston American Energy Corporation may get some type of upside reversal going this week based on the reversal hammer I see and the test of recent support area.

This stock came up in a scan from my scanning software. I was trying to make a formula that finds reversal hammers with long lower candlestick shadows and a hammer body size that is significantly smaller than the entire days range. Needless to say it was quite a pain at first to work this formula into the software but I think I got it working now and it seems to be churning out some interesting setups such as this one.

I think reversal hammers are a lot more reliable after there has been enough significant choppy price decline before the hammer occurs. In the case of HUSA, I see that we so far only had 2 big down days that were very fast, so it may make this hammer reversal less reliable and there could actually still be downside continuation this week.

However if HUSA can manage to stay above 13.5 on Monday (4/12/2010), then it could be that some type of reversal could get going into Tuesday to Friday of this week.