The SPDR Gold Trust GLD ETF looks like it is just about ready for another big move. Some time ago I did a post on why I thought it was prudent to be cautious on gold because there was at least the potential of a bearish weekly divergence developing.

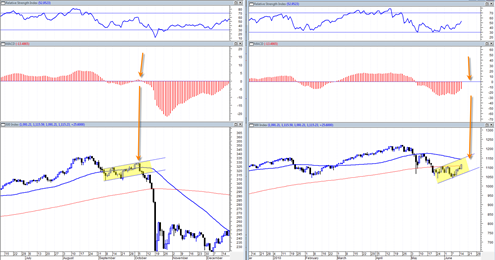

That bearish divergence has failed to play out. And now the gold market finds itself in a position where the daily MACD is just about to turn bullish and the gold price is compressed into an ascending triangle. In addition the weekly chart and the monthly chart still look bullish.

So I have to tip my hat to the bulls here. The monthly RSI is right into the powerzone and has plenty of room for upside expansion.

As long as the GLD maintains the current supporting ascending triangle structure I think you have to be open to huge upside moves.

If we see any closing prices below 120 in the week ahead then it would change the near term very bullish outlook and could completely reverse my opinion. But for now I have to say the GLD has everything going for it to the upside and actually an entry right near these levels with a protective stop at 119 seems like an outstanding risk/reward.