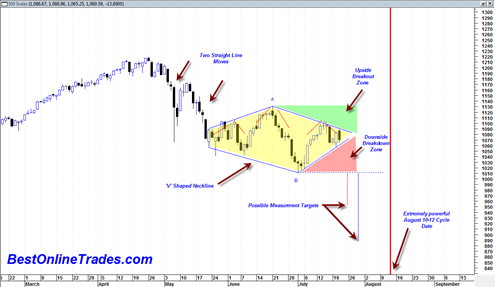

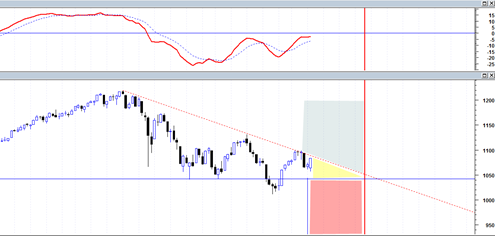

The weekly chart of the spot gold price shows that gold setting up for a very important test next week. The test is to see whether or not the gold price can hold longer term uptrendline support on the weekly chart.

The uptrend shown in the first chart below is a 2 year uptrend line and has a good degree of significance. If we break down through this trendline on the weekly chart next week then one has to question the current integrity of the gold bull market in my opinion.

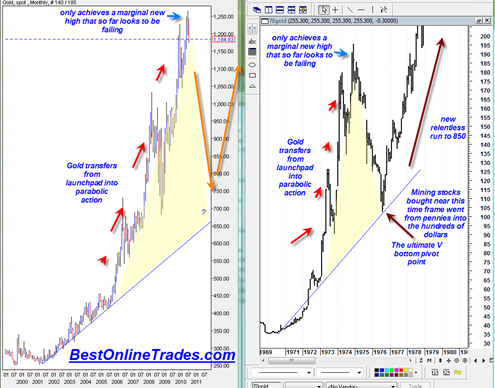

I did a couple other recent posts pointing out the weekly bearish divergence on the gold price chart and the similarity to the mid 1970s gold price topping formation.

If gold breaks down through the uptrendline next week then it would probably challenge the 1160 level which is an important level of support as it was the neckline level of the previous inverse head and shoulder bottom formation (see it drawn in on the first chart below).

If 1160 breaks then it could imply an eventual test of 990 level which once again is a very important level of support and again the neckline level of the previous massive inverse head and shoulder bottom formation.

Perhaps I am looking much too far ahead, but if we do get to 990 and then 990 also breaks it could imply a move down to 680 as a possible final bottom. That would be roughly a 46% drop from the spot gold all time highs.

I think it is important to keep in mind that the gold price has been going up since 2001 or almost 10 years. I am probably repeating this line of thought from a previous post, but even very strong bull market uptrends sometimes need a mid point correction as a pivot point for the eventual blow off down the road.