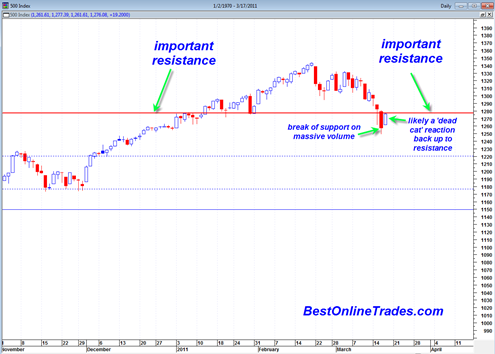

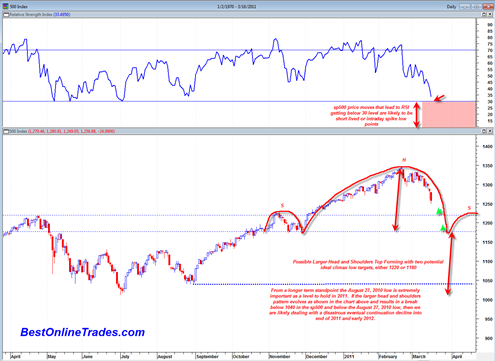

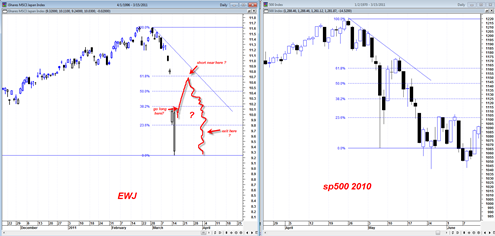

The bearish case I have been ranting about in the sp500 may be dead as of today. Especially if we close near the highs. If we close above 1300 it could mean a swift move up to 1330 and only THEN some type of retracement which would lead to a right shoulder forming of a head and shoulder bottom formation.

This market has been characteristic of blowing the bears away and in true form seems to want to do it again. Whether or not it can accomplish this by the close remains to be seen.

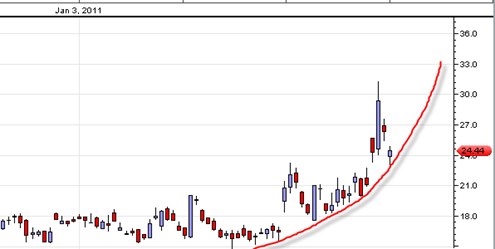

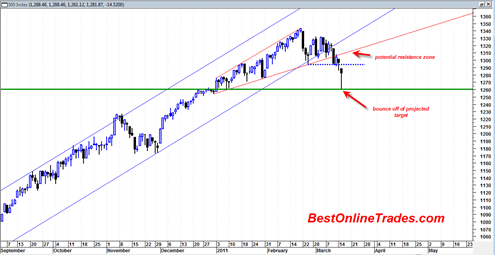

The way that the Nasdaq 100 has been retesting its 2007 highs was definitely a concern for the bearish case. Why? Because it could simply have meant that the decline is over up to this point and a simply retest of the 2007 was at hand. Today we see a strong reaction up off of this retest and it really does cause issue/concern with the more bearish case.

There is also something else going on now, namely the US Dollar index. It has broken down badly out of a 5 year symmetrical triangle formation. This means that equity and commodity prices are likely to be supported. This is basically the same pattern that has been happening for a long long time now. It will probably mean that the DJIA will be able to get to very large numbers while the real buying power of that number is maybe cut in half.