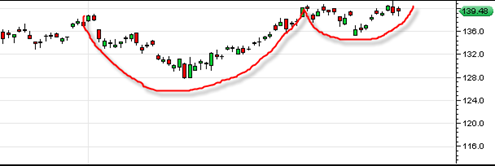

A comment poster wrote me and asked me if I thought the SLV ETF was a good long from the 37 level. My response would be that one should be keenly aware that the SLV has already made a huge move from early February 2011 up until the present time frame. Early February 2011 was the ‘easy buy’.

Now the SLV is in a more mature advance stage and I think if one is going to go long from here it should be more a shorter term swing trade long position with a tightly controlled stop.

Why? Because even though momentum still looks quite strong, the chances for more technical selling coming in more heavily are more likely during this stage. So if one gets too complacent, there is the risk of getting caught in a big profit taking wave.

So, I would say that if I were to go long the SLV from here I would try to do it from 37 or slightly under and then set a protective stop loss at 35.70. That would put the stop loss right under the recent break out area. Assuming an entry at 37 and then assuming the stop loss gets hit the same day or next day it would equate to a loss of 3.51%.