I am taking some downside heat on DBLE, the second trade of the BestOnlineTrades Cheetah Trading System. I don’t intend to sell out based on today’s action for now. I have to be careful about accumulating too many trades in the early going without enough profit to work from. 10 round trip trades at my current commission rate of 7.95 would be about 16% of $1000. That is quite problematic and does show how excessive trading can really damage an account just on commissions alone.

So for now I will stand ground on DBLE as I still believe it will work into a breakout.

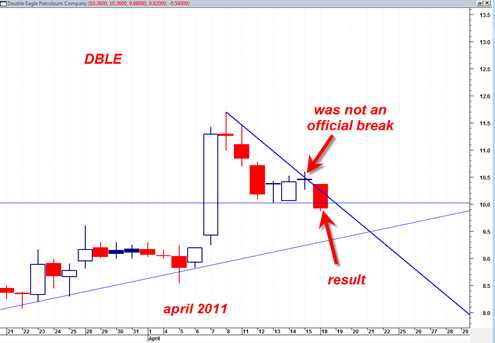

I will say though that I realized that I have made another mistake with regard to my entry on DBLE. I entered DBLE at the time it was appearing to break out north from the downward trending resistance line during the day. But the mistake was that at the close it was NOT an official break. In fact by the close of the day it closed right under the resistance line. So this was the type of day where waiting until 3:59PM would have been very useful as I had written about before.