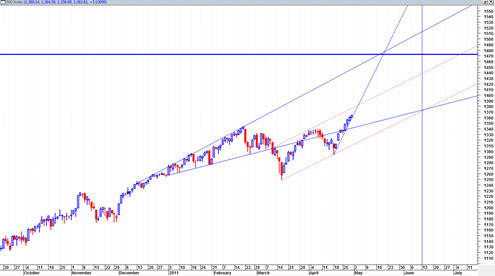

The sp500 today broke down through key support and volume was robust again. A day like today is not supposed to happen if the market is still bullish. Indeed today could be an important warning sign that this market wants to transfer into a more complex correction. The up trend at this point may be on pause.

At this point I am still going to refer to the red dotted channel line as the key level that either holds or not for me to switch to outright bearish again. This is a key channel.

Interestingly, the test of the bottom portion of the channel may coincide with some type of decision on the debt limit increase of the United States.

I do see that the daily MACD is in bearish mode and also the WEEKLY MACD is re confirming a bearish mode and trend. The bearish weekly MACD is not something to be taken lightly now because if it continues it can eventually start to affect the monthly MACD and really start to roll this market over into a new down trend.

But it is still early and again, I want to see a break of the red dotted channel before I throw my hands up in the air and call this a new mini bear.