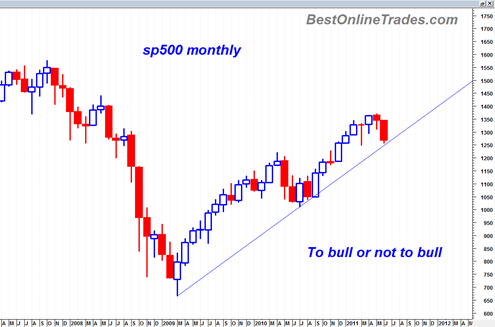

It appears as though today may be yet ANOTHER whipsaw signal on the sp500 delivered by yours truly. The market cannot make up its mind whether it wants to go down or up and I am cannot either. I am getting thrown around in the spin cycle of a washing machine.

Today was another good example why it is usually not a good idea to get a strong conviction during trading hours as opposed to the closing price and final message of the market.

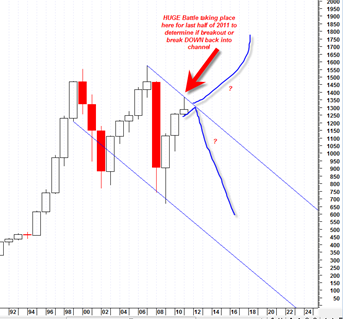

The close today was a high volume shakeout reversal on most indices that printed a strong looking reversal hammer on a candlestick basis.

After today’s close the upside is looking more favorable again. What a difference a few hours can make!

But you know what ? I would rather be ‘light footed’ giving multiple whipsaw bad signals as I have during the last 2 weeks instead of being ‘heavy footed’ stubbornly sticking to a bearish signal and then getting crushed and staying in denial when the market goes against me. Light footed is a good thing sometimes.

I may have to switch back to a BOT long signal again depending on how things look into next week.