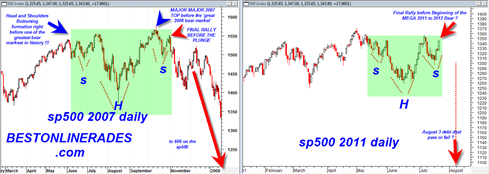

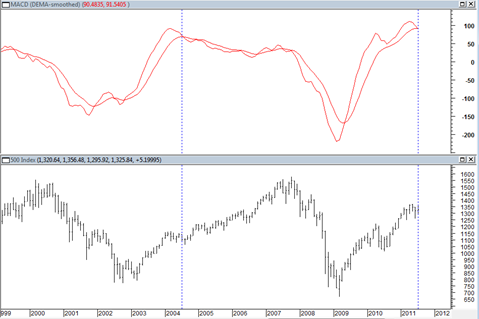

This Elliottwave site makes a comparison between the 2007 and 2011 time frame to argue possibly that we are at a similar juncture for a break down as was the case in 2007.

Recently I have also done a 2007 2011 comparison with respect to the head and shoulders bottoming formations that were occurring near market highs. The comparison is compelling and the elliottwave argument is also compelling.

Having said that I have to admit that the recent talk by politicians and TV network pundits on how the stock market will crash this Monday if there is no debt deal is quite concerning from a contrarian standpoint. Suddenly the politicians and the TV talking heads are expert stock traders and can predict a market collapse this Monday?

Something does not click here. From a contrarian standpoint I have to say that all this ‘market will dive’ talk unless there is a huge deal by end of this weekend is concerning.