This is a follow on update to my previous post during mid day where I was talking about an important volume swing test that the SP500 was doing today.

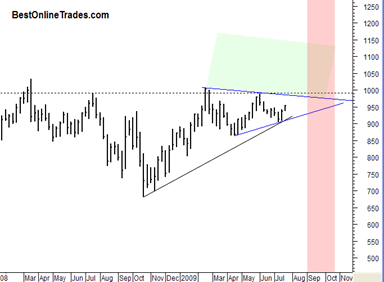

The comparison is between the 6/11/2009 price swing on the SP500 which had an intraday high of 956.23 on volume of 1,222,768,700 (NYSE Volume). Today we tested that June 11th swing high on the SP500. Today’s high was 956.53 and today’s volume was 1,207,021,284 (NYSE Volume). The close on the SP500 today was 954.21 so we ended up closing below the 6/11/2009 swing high.

It was a successful volume swing test because the volume today was only about 1.3% less than the 6/11 swing high, so we are within 3% which is enough of a signal and indication to me that the market can continue higher from here.

Note that we did close under the 6/11 swing high. So the volume test was successful but price did not manage to close above the swing high. So it says that we could base around here at these levels for a bit or even do a pull back to the previously mentioned heavy volume gap on the SP500. But even if we pull back from here at the top of this trading range, the market is still saying based on volume that it will ultimately break these swing highs.

The Nasdaq, or the QQQQ as a proxy for the Nasdaq is leading the way to the upside and has already broken the horizontal swing point levels. So that is a hint in my opinion of what is to come for the SP500. Clearly the Nasdaq is the strongest index out there right now.

It is pretty amazing to me that this possible upside breakout is developing right as we sit here before August, traditionally one of the lowest trading volume months. But regardless of the seasonality, we must respect what the price and volume is telling us.

Read more