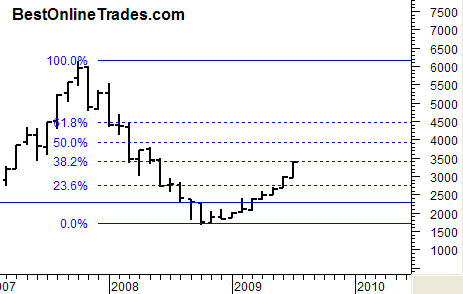

I think the 500 billion plus economic stimulus package that the Chinese implemented is working, not just working but working really well. Just take a look at the Shanghai composite Index. The rebound recovery rally in the Shanghai composite started about 4 or 5 months earlier than the USA’s recovery rally as measured by the SP500.

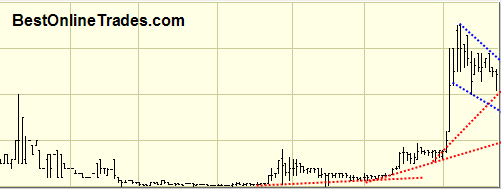

So far the Shanghai Composite is up about 104% from the intra month lows in late 2008. Wow. That is pretty amazing how far this index has come and how fast. It has me thinking that if this index continues powering higher up and through the 38.2 fibonacci retracement level there is probably going to be a mad panic rush to China stocks. Of course there already has been plenty of activity in Chinese stocks, but it could go into overdrive with the cooperation of this index.