I want to do a quick refresher post here on BEHL. BestOnlineTrades first mentioned BEHL on 7/23/2009 close to 3PM eastern time. On that day the intraday low for BEHL was .021 and the intraday high was .0255. It closed at .0255 .

I want to do a quick refresher post here on BEHL. BestOnlineTrades first mentioned BEHL on 7/23/2009 close to 3PM eastern time. On that day the intraday low for BEHL was .021 and the intraday high was .0255. It closed at .0255 .

Today BEHL closed at .0365, 43.14% higher than when it was mentioned on that day.

The price structure and performance so far still looks quite promising to me. I indicated before that I liked the clean volume advance which looked like heavy accumulation and the rapid decrease in volume on the retracements. And as a bonus that volume and price action was coming off of a fairly long flat base of 7 to 8 months in duration. This is important because many times it shows that a stock has entered a major new uptrend phase, or mini bull market if you will.

But the reality is that most penny stocks simply do not make it too far into their new mini bull markets. They try and they fight to get higher but a lot of them just can’t get enough steam going and either the price advance is TOO LABORED, too slow or the retracements in between are too large and cause the advance to lose too much energy. These things can kill the advance and cause the move to be a false one.

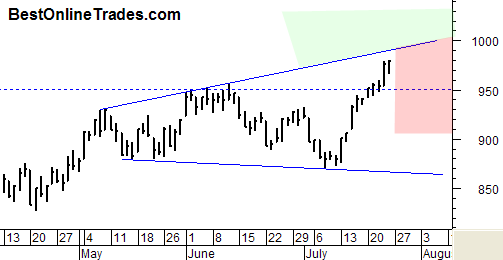

The SP500 looks like it wants to get a retracement going. Currently I am thinking somewhere near the 950 level as I mentioned before being minor support and normal in the sense that often one will see price retrace right back to the breakout area.

The SP500 looks like it wants to get a retracement going. Currently I am thinking somewhere near the 950 level as I mentioned before being minor support and normal in the sense that often one will see price retrace right back to the breakout area.

BestOnlineTrades.com has spotted ETRADE corp ETFC as a possible upside trade this coming week, possible as soon as Monday morning (this morning).

BestOnlineTrades.com has spotted ETRADE corp ETFC as a possible upside trade this coming week, possible as soon as Monday morning (this morning).