BestOnlineTrades recently developed a powerful new computer scan that scans over four thousand five hundred different stocks (Nasdaq and New York Stock Exchange). It is a superb scan because out of that entire list of 4500 plus stocks it only returned 1/3 of 1% as viable candidates! (.27%) And it typically seems to only return a maximum of 20 stocks each day. That is extremely valuable not only because of time savings, but also because of the quality of the candidates it seems to find. It is a custom scan I developed that uses a combination of two very powerful indicators. One of them happens to be an indicator that the famous Jake Bernstein likes to use a lot. But when used in combination with our own custom indicator, the quality factor goes up 5 fold.

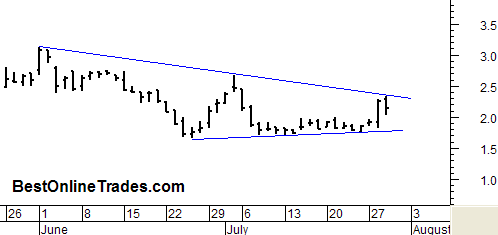

PACR Pacer International is one of the stocks that came up in the scan and we are glad that it did, because it looks quite good to these eyes. The few months to the left of this chart are also significant (not shown on the chart above) because in March PACR did a nose dive into the 1.7 range area, then it rebounded to the 5 level only to fall back where we currently are in this congestion area.

So one could say that the current retracement is a complex double bottom and now we have built sideways cause here for about a month and are perched just under the resistance line close to the mid 2’s.

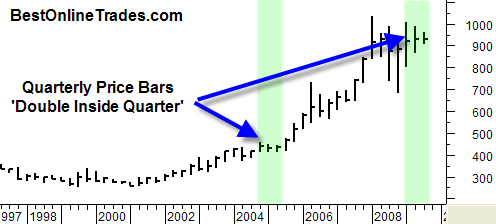

Yesterday I was talking about how I noticed a confirmation sell signal on the QQQQ’s based on price and volume. But today we really don’t seem to have confirmation either way. Volume was slightly higher on the Q’s but as far as price goes we did not test either the high or low of yesterday so we really don’t have much new information to go on. Today is considered an ‘inside day’ since we stayed within the low and high of yesterday. Tomorrow, if we again stay within the low and high of today, then that will be a ‘double inside day’ and would be a sign that a big move is coming. Confused yet?

Yesterday I was talking about how I noticed a confirmation sell signal on the QQQQ’s based on price and volume. But today we really don’t seem to have confirmation either way. Volume was slightly higher on the Q’s but as far as price goes we did not test either the high or low of yesterday so we really don’t have much new information to go on. Today is considered an ‘inside day’ since we stayed within the low and high of yesterday. Tomorrow, if we again stay within the low and high of today, then that will be a ‘double inside day’ and would be a sign that a big move is coming. Confused yet?