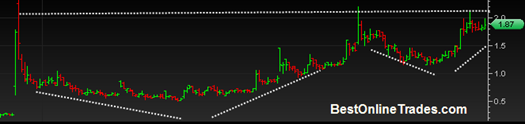

Biotech stocks can be very tricky trades and very unpredictable, but I still thought DVAX was worth a mention as it appears to have a large favorable pattern also known as a cup and handle pattern. The entire pattern is about 9 months in duration. That is appealing just based on how long it has been forming. To me, a 9 month cup and handle is a lot more valuable than a 2 month cup and handle chart.

Anyway, it appears that the handle is almost done forming and we could see a big breakout type move out of this pattern, possible in August time frame. One could also make the case that the handle portion of the DVAX chart is actually a smaller cup and handle pattern itself. That is an interesting type of symmetry and something I do not see all too often. It is a nice clear signal that helps to make for a clean move.

I really would not want to see anything below 1.74 on DVAX to keep this entire pattern intact. If it does move below 1.74, then there could still be a case for an eventual breakout, but just for the sake of being ‘picky’ I think that is the standard that needs to be set here on DVAX.

After a violent retesting action in the UNG ETF I believe that UNG has now bottomed and should embark on an eventual retest of the 17.55 level.

After a violent retesting action in the UNG ETF I believe that UNG has now bottomed and should embark on an eventual retest of the 17.55 level.