I originally thought that the market would drift sideways for a few days right into the Fed Meeting because there was a month long support shelf that the SP500 was hitting on Thursday of this week.

But obviously that shelf was decisively broken to the downside once again today and again on similar record volume.

So that sets up a scenario next week for a violent upside turn around right into the January monthly closing candle. It appears that the turn around would occur right near the Fed meeting. You could have no change in rates next week and statements from the Fed that the ‘economy is sound’ or in ‘steady recovery mode’ , the usual blah blah blah you hear from them and then that can serve as a psychological turn point (notice the ‘psycho’ portion of the word psychological ? 🙂 ).

That is usually how I have seen turns come about in the past. So then perhaps you get a bounce right into end of next week on low volume which would set up another extraordinary shorting opportunity at the start of February.

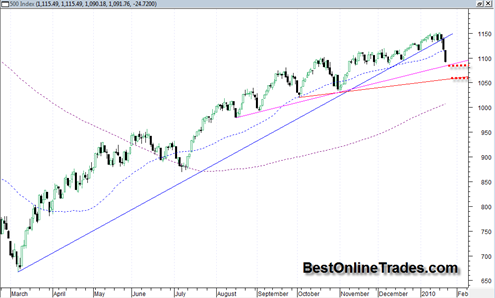

There are two supporting channel lines that I think the SP500 will find as short term support. Check out the chart below. Also it is worth noting that so far we have two full black candlesticks from the last two days action. If we get another full 20/20 bar black candlestick similar to the last two days, then that would qualify them as ‘Three Black Crows’ candlestick pattern which is very bearish especially coming off the top like we did on such huge volume.

The pink supporting channel line seems to have more merit as a stopping point as it has already stopped a total of 3 ‘V’ shaped corrections. So a small opening exhaustion gap down on Monday with no follow through would be the first clue that this pink line will hold and serve as catapult going into Fed meeting.