At Mid Day the sp500 is trading flat showing nothing dramatic or shocking. It appears that this will continue to be the case by the end of day today. Sometimes I have written posts half way through the market trading day and then by end of day the exact opposite occurs to what I was expecting. I don’t think this will be the case today, but I have been wrong before when I have written mid day posts.

If we maintain flat to higher prices today then the market will have a monthly MACD histogram buy signal confirmation as of the close today. There is no way I can explain that away. The market has shown two monthly signs of strength going into the traditionally strongest seasonal time of year, not to mention the favorable election cycle bullish seasonals.

Closing near the top of the range on the October 2010 monthly candlestick does not mean that early November cannot start out with a correction, it can. I was just making the case that if we had done a strong retracement to 1150 or near there today then it would have at least opened the door to a potentially much more bearish first two weeks of November.

Since we appear to be closing at the top of the range of October 2010, then a correction in November is likely to be a simply ‘dip buy’ type correction, instead of a more dire scenario.

Still, the last 5 or 6 trading days in the sp500 do not show any forward progress and show a series of doji, hanging man, and shooting star candlesticks. All of these seem to indicate we are at a pausing point. All of them are unconfirmed in that we did not get a close below any of them. It would take just one robust down day to confirm all of them at once.

But the other issue is that the longer we continue to hover right in the recent range without breaking down and just ‘hugging’ right under the April 2010 highs, the more it would seem to suggest that the market wants to initiate a topside breakout into and then above the April 2010 highs. Sometimes what the market does not do (get downward correction going) is an indication of what it will do later on.

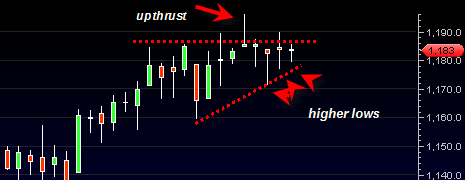

Using price as a leading indicator, I would say that the sp500 needs to get a close at or under 1176 as the first sign that we are ready for some type of downward correction. 1176 represents the bottom minor supporting line of what appears to be a small ascending triangle formation in the sp500. Not the indicated upthrust and the recent series of higher lows.

Price itself is the ultimate ‘decider’ at this point. In previous posts I have already pointed out the toppy nature of the summation index, the percent of stocks above the 50 day moving average, the daily MACD. But all of those indicators are not going to help bring the market down if price busts right above and close above 1190. 1190 is the key range for a topside breakout.

I will change to BOT long signal on a confirmed break out above 1190 range, but until then I will keep the current BOT Short signal intact. Only price action that forms on a closing basis around the above pattern should be considered valid as up thrusts and hammer reversals can be quite common.

‘Buying high’ way up here in the clouds appears to be complete insanity. But we must respect price as the leading indicator here and let it show us the way. The monthly and weekly trend is now quite bullish and seems to be supporting the market quite readily.

Lastly, it is worth mentioning again that the SMH is trading quite strong today after recently breakout out topside from its long trading range.

It could very well be that the proper interpretation of the SMH semiconductor index and the Banking Indices, is that they are simply being dragged along by the other averages and area ‘late to the party’ so to speak in terms of being able to break out above their trading ranges. Before I was considering the possibility that the banking index would drag the market down with it. But the opposite could be happening. The broad market indices will drag the banking and semiconductor indices higher. Tech is the leading group and is already well above the April 2010 highs.

Tom,

Thanks for the update.

I will prefer to be on sideline than BUY in this market. Let all indicators scream STRONG BUY, will still not buy.

Only if I get STRONG hint of dollar weakness (dollar index breaching 72), I may jump in to buy but till then NO to BUY.

At this point I am expecting a correction from the August low to the October high which on the S&P is approximately 150 points. Therefore I am expecting at least a 30% correction or about 50 points more or less.

Coincidentally around 1140 there is a lot of support. But t1120-30 will be the real test for the bulls.

Looking at the fibernochi numbers this really looks like the point for a correction and it holds not only on the S&P but also the Dow Industrial’s and the Wilshire 5000.

Shrihas, sidelines sure is a nice place to be. I should probably be more on sidelines than I have in recent past. I agree with you about the Dollar Index as well. I thought it would have a huge reaction up and hit the stock market, but now it could very well be that the stock market will get to have its cake and eat it too if the Fed gives them what they want next week.

Commodities are on fire lately and that inflationary trend seems to be pulling the stock market higher as well…

JR, my take is that we may still get some type of correction in early November, but now I am more unsure about how deep it would be. We are way overdue for one. But it may only be a 5 to 10% correction. And maybe also need to keep an open mind that DJIA and sp500 break up once again next week above April 2010 highs. It seems crazy, but not impossible.

To get a real feel of the total market, I always like to look at the Willshire 5000 as previously pointed out.

The RSI and Stochastics are really a good guide as to where the market is going especially in the short run. Both are showing over bought with Stochastic reading not only showing overbought but also a sell signal.

I think at the end of this week Nov. 6th. We will see a market beginning a significant correction and everyone looking to some fundamental news event as to its cause.

Those of us with a technical bent will be smiling and saying its all in the charts.

Side bar: Why is it that the crowd is such believers in the idea that “markets always go up”?