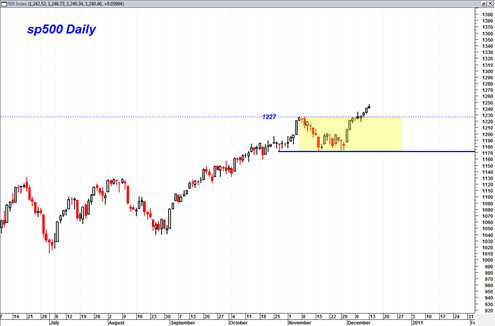

The sp500 continues to trickle higher into new ground. I do not think that we can call today a shooting star reversal in the sp500 because the topping tail was very small on the candlestick today. In addition, by the end of the day no retracement was done into the previous days candlestick. Still, it was a reversal into end of day.

The relative strength index is coming close to the 70 range but has not broken through yet. I have noticed that the 60 to 70 range for the market indices can be a typical topping point for the market, or at least a point where prices can start to move sideways and consolidate. The daily, weekly and monthly MACD are still in a bullish crossover stance, however the MACD histogram on a number of important indices (such as the Dow Transports and Nasdaq 100 Index) are currently showing an unconfirmed bearish triple M pattern. This could mean the start of some type of corrective phase this week.

1227 remains the key level right now as the top of the recent trading range. I think a long bias is appropriate above this level. But anything below could start to raise some red flags.

Ideally for the bullish case we would see price start to retrace slightly back down to the 1227 level and then reject it in the form of a Wyckoff retest.

I do not see any point in switching to a BOT short signal at this point, however if and when we fail to hold 1227 I might have to reconsider.

call me a bear, look at McDonald MCD

Looking at the Daily SPY chart I can see a bearish Meeting Lines candlestick pattern

Personally, I think we are dealing with a market of stocks not a stock market. That is why, I can take short and long positions on the same day, in different stocks of course.

I closed out my short on LVS today at 44.92 took a short position Friday at 46.12

At the same time Friday I took a long position in DRYS and RAX. I am not seeing any short positions that look attractive today. But there are lots of interesting longs.

At present the momentum is on the bull side. Short term trades taking advantage of repositioning Friday seems to offer opportunities on the long side for tomorrow.

Strategic shorts are possible, but the direction of the market is up, the momentum is up. The market is short term over bought. Providing for short term shorting opportunities. But be careful, the direction is still up.

OK, now for out on the limb projection. 12 month forecast, S&P above 1400!

This is why I am so cautious on the short side. That said there will be lots of shorting opportunities. Watch the RSI. Never short a stock where RSI is below 40! You might make money but why take chances.

At present half my capital is not committed. This is not the time to be all in! Not even for an hour!

Funny you mention MCD, I noticed that chart yesterday and was thinking the same thing myself. I guess they got hurt with currency issues from their international stores. MCD still might hold support though.

Larry Pesavento indicated yesterday that Dec 13th was a Bradley model turn date and he said the market needed to go down very soon to confirm it. So far does not seem to be working, but still early in the week.

Yes JR certainly a mixed bag out there of stocks… some very weak and others very strong.. But most of them seem to either be flat or in uptrends.

I think your 12 month forecast will be correct at 1400 and especially so if the sp500 can hold above 1220 in Jan and Feb 2011.

Since on BOT, I am referred to as the EW guy. I should mention that EW is predicting a sharp reversal right about here. 1250 on the S&P 500. Topping on a wave five.

Also, the McClellan Oscillator would support that down turn.

However, I expect an irrational market for the rest of the week, due to the triple witching and funds repositioning up to Friday.

I intend to go flat, Friday AM!

I am seeing an interesting wedge forming in several of my long positions.

It seems highly probable that these indecision patterns will be resolved on the down side.

A long overdue Christmas present for the bears.