The volume was again very weak on today’s rally in the sp500 relative to the previous swing highs 4 or 5 days ago. But I have to say if we get another full bullish bar tomorrow in gap and go form then it is going to put into doubt the more accelerated bearish weekly forecast I was thinking was going to occur in previous posts.

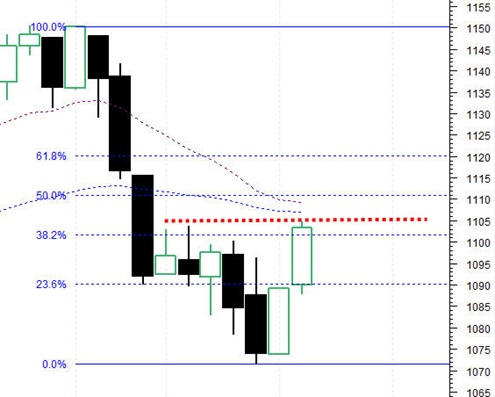

If we do rally tomorrow, it would be ideal to rally but then close flat or negative by the end of the day to create a large topping tail. But again, if we do not do that and instead get another full bullish price bar above the trading level defined by the red dotted line then something else is going on in my opinion.

The fibonacci 61.8 retracement level is near the 1120 level. That level to me would be the last acceptable retrace level to still allow for more bearish trend development later this month. I would rather be picky and select the 1105 level as the line in the sand. Price stays under 1105 then I stay short, but above 1105 just wait and watch.