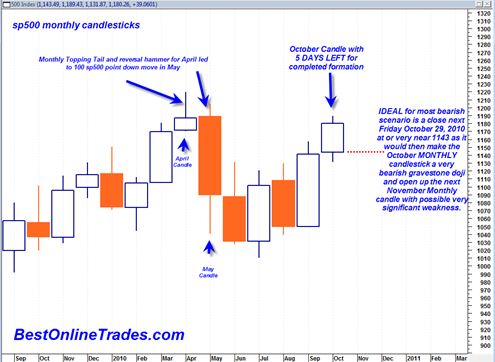

Who says you cannot trade off of the MONTHLY sp500 candlestick chart? When it comes to end of month it can be a useful guide for the potential trade setup. There are exactly 5 trading days left in the month of October not including today. That means that next Friday, October 29, 2010 will complete the October 2010 monthly candlestick.

If you have been reading my posts then you already know that I am looking for downward price action either into the November 2 and 3rd time frame or at the very least a sideways price action into that time frame and then downward thereafter.

In my view the bear dream scenario is for the sp500 to close near the 1143 range on 10/29/2010 because that would put the closing price equal to or nearly equal to the monthly October opening price. This would in effect create a very bearish looking topping tail on the Monthly October candlestick similar to the one that formed in April 2010. If we close 10/29/2010 exactly at 1143 then it would create a reversal doji. If we close slightly under 1143 then it would start to look like a gravestone doji which would be more bearish.

In the chart above one can see that the reversal hammer of April 2010 led to a huge 100 point + decline in sp500 in just 6 trading days that started May 2010. Of course after that the May candle continued to form with very WIDE up and down swing trading ranges as the monthly candle continued to take shape. I do not know if we can get another flash crash or 100 point down in first 5 to 10 days of November like we got in May 2010. But I would say that a very important pre condition for such a repeat would be a 1143 or lower close on sp500 by end of next week.

So the dream bear scenario is for the market to close at 1143 or under by end of next week which would then lead into a potentially bearish ‘sell the news’ event of the elections and Fed meet.

On the other hand, closing at 1180 by end of next week would not be too helpful for the ultra bearish scenario. It might imply that the worst we might see in first week of November 2010 is just a 3 to 5 day downward shakeout.

So there appears to be a lot at stake for the last trading week of October 2010.

Choppy trading is fine next week, but again we really need to see some sign of weakness (big down candlestick) sometime next week to help the bearish potential.

If I want to be really strict I think I almost have to say that it is a very important requirement for the sp500 to trade near the 1143 range by end of next week. That is the very strict interpretation and requirement needed for a very hard down early November ‘sell the election and fed news’ type scenario.

It seems we have a gap and uptrend on Monday 🙁

now add a Detrended Price Oscillator (DPO) indicator to the monthly

http://forex-indicators.net/dpo-detrended-price-oscillator

Previously, in as the World Turns, I suggested a S&P close above 1180 would, at least for the short term which may be as short as a week, be a bad sign for the Bears.

But for sure today’s close at 1183.08 indicates that the course of least resistance is still on the upside.

Now for the fundamentals, regardless that real estate is down and will take at least another 15% hit and regardless that unemployment will stay stuck at 9%+ for the foreseeable future, corporate America is in good shape. It adapted well to a terrible recession, many if not most, have a comfortable cash reserve and even with reduced gross sales their bottom line is looking good.

Plus new technology such as cloud computing has the prospect of squeezing out more productive for business.

Forward looking PEs for the most part are quite positive. Plus the currency benefit of a lower dollar also helps.

With all this said, and my previous comments about the DOW confirmation of upward direction, and other bullish technicals, in my humble opinion the Bears will just have to wait this one out.

And Oh by they way, predicting tops is living very dangerously.

I guess I should throw in that the S&P made a golden cross today, that makes among others the DOW Industrials, Transportations, Utilities etc.

in my opinion, this market is incredibly long in the tooth (overbought). BUT i suppose (my worst fear) is that we could get a big one or two day move UP and that would be the end. . . . from there we would drift down for months.

I.e., “Dream Bear Scenario” – – – – i wish the very very hard working analyst would stop jumping the gun. but i suppose that is the predicting game. but as a reader, i try to almost completely discount the “headlines” of the posts here. . . they almost never pan out. but the posts are interesting to read.

http://mcclinbeursanalyse.blogspot.com/

alert next week 43/44/45 dow,s&p dax,aex nikkei

OK, just for the fun of it I thought I would add a few more indexes that have created a golden cross: Wilshire 5000, Nasdaq 100, Rusell 1000 and 3000, and Value Line!!!!

This really doesn’t look like a bear market! Nor it it predicting one in the near future.

don’t confuse a minor correction for an all in Bear Market. At least that is what I think. Thus Spake Zarathustra.

i am a bear.

and i think there are lots of reasons, both technical and fundamental to be extremely cautious at this point, BUT

i think there is a fundamental flaw in the posting. this posting is based on “wish”. while it is helpful to know that IF a certain action develops, it would give a certain monthly candle, that, to me, is different than actually forecasting that such a candle will develop.

Hey Geoff:

Thanks for you postings, I always look forward to them.

Of course, I agree with your idea of being a bear.

You can look at America or Corporate America and find many deeply troubling areas.

However you could have done the same thing with the Roman Empire at its height, and it still lasted another 400 years.

The overall global economy and our military influence has been very good for business just as it was for Rome circa 60 BCE.

Our economy is bad but not so bad for corporate America. Bad for the middle class but not bad for the Oligarchy. Not bad for the military.

And unfortunately they are the ones who count.

They are in control and their minions look after their corporate interests. With of course the help of their political minions.

For the most part we are just along for the ride.

The only thing we really need to know about the stock market is what direction the oligarchical wind is blowing and being nimble enough to stay out of the way of being stepped on by the elephants!