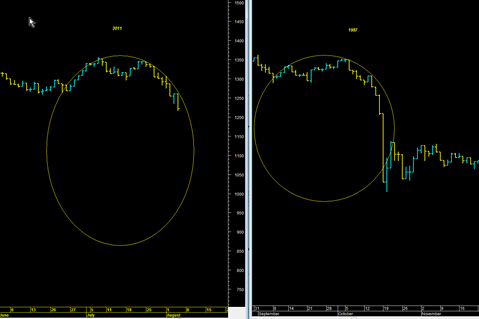

The sp500 today was not able to bounce as I thought it would. Instead the market chose to take the full crash mode option. There is not other way to describe this type of move. This is an all out crash and it has similarities to the 1987 style crash.

We are about 10% down so far and could easily drop another 10% in a day or two. The price candlesticks are similar to the 87 style crash in that they are MARIBUZU candlesticks where the opening price equals the high and the low price equals the close. This basically shows that someone or something is unloading huge amounts of stock all at once.

The 1987 crash saw the WORST part of the crash occur after the RSI starting moving under the 30 percentile line. Right now we are already under the 30 level and slightly under it.

The low for RSI during the 1987 crash was about 11.5. If we are to do a similar down move either on an intra day or on a closing basis then we could see the sp500 trade at 1050 within the next few trading days. That would mean another 15% down from today’s close.

Having said that, there is no way I can predict if we are going to slide into full tilt crash mode the next few days. We are in unchartered territory now. I can make the case that we are extreme oversold right now, and that we are near some supportive swing low structures, but the problem is if we get a stampede and everyone wants out, then there is nothing to stop the market from collapsing.

It is interesting that the low today in the sp500 was at the same level as the small shelf that existed at the peak of April 2010. It would be a technically ideal place for a bounce. But if we slide under there and the stampede continues, then it could open the door to even farther down.

The jobs number is coming out tomorrow. Perhaps that would stop the slide, but then the issue is who would want to hold long over the weekend given the current meltdowns happening everywhere.

It seems inconceivable that we could hit 1050 on the sp500 (either on an intra day or closing basis), but we are in a zone now where technical analysis may not do us much good.

I thought that August was going to be typically slow! But as it turns out this is the most volatile August maybe since the 1987 crash!

If we do gap at the open tomorrow, I may day trade some August call options on the SDS and possibly hold them till Monday.

I have to admit I am quite surprised at how quickly the market has fallen apart in August. In previous postings I was talking about how September October Time frame would be the most devastating decline of the bearish monthly divergence. But I did not know it would arrive so much earlier on schedule !

I suppose crashes tend to happen when no one is predicting them and this time around I do not recall too many predicting a crash right here and right now, in August 2011.

How to know if we are in full crash mode?

Simply watch the daily RSI and look for it to absolutely PLUNGE below the 26 level with possibility on an intraday basis it could reach as low as 11 (this is what occurred in the 1987 period).

Obama celebrates his 50 bash with a 500 point down day on the DOW. Oh the irony..lol. (Actually its not funny)

yeah crashes come out of left field. Everyone was predicting a bounce (including me) after the debt deal was done and the big boys took that opportunity to dump. The volume analysis would be interesting to compare to 1987. We did about 500 on SPY and over 400 million yesterday, with the maribuzu candles it feels like capitulation type volume; I feel like it would be difficult for markets to plough through another 10%-15% without some kind of a bounce. The marekt always look ahead and I wonder if its discounting some news that’s not out yet. Its very reminiscent of the 2008 crash. I wouldn’t be surprised if we see a major country in Europe defaulting or a muni bond default of some sorts…

On another note, Tom may be right about the top in this martket. Tops on a market are impossible to call. But if it is truly the top, then my bearsih M-A pattern will start playing out. If the pattern does play out, the SPY will head to low 40 level, about 1/3 of where it is now. Obviously that will take years to happen and markets will have solid bounces along the way. but we’ll be in a bear market where the trend is down…

I think the analysis yesterday was correct. Yesterday gave us a bottoming tail, with today should have been an up day.

I guess the way to trade this is to protect oneself using stops. I did not trade, but if did, I would have put a stop halfway down yesterday’s tail. If spy did not immediately take off to the upside, I would be protected.

The other point is never to trade against the trend. Right now, the trend is DOWN. So all trades should be to the downside.

Yikes! – – Tonight (Thurs nite) the Hang Seng Index is back to the Sept 2010 level. If the Dow gets in similar position, it will be trading at 10,000

Neither the 10 moving average of Arms / Trin or Advance/ Decline is anywhere close to extreme bearish levels. Neither is investor sentiment as per last wkend’s Barron’s.

Yes it looks like we may have a big down day tomorrow but I expect us to be back above today’s close by next Thursday. After that I will reshort as we will probably continue with more downside again